The €2 Million Mistake: Trust Without Verification

In 2023, a European machinery importer signed a €15M contract with a Chinese supplier. The supplier’s official records showed a reputable director with no red flags. Confident in the paperwork, the European firm paid a 30% deposit (€4.5M). Months later, shipments stopped. The “director” vanished, and assets were untraceable.

The shock: The company’s real controller was an undisclosed shareholder with a history of fraud lawsuits. By the time lawyers uncovered this, €2M+ was unrecoverable.

Why Undisclosed Shareholders (Nominees) Are a Silent Threat

Under China’s legal framework, nominee arrangements—where a registered shareholder fronts for a hidden beneficiary—aren’t illegal. But they create severe risks:

| Risk Type | Impact on Foreign Partners |

|---|---|

| Asset Obfuscation | Hidden owners shield personal/commercial debts |

| Liability Gaps | Legal claims can’t target the true decision-maker |

| Enforcement Failure | Courts struggle to freeze assets or enforce judgments |

Critical Legal Updates (2024 Company Law):

- Article 23: Shareholders abusing limited liability to evade debts face joint liability (piercing the corporate veil).

- Article 89: Transferees of unpaid capital shares inherit payment obligations—hidden owners can’t dodge this.

- Article 178: Directors/controllers violating “duty of loyalty” face personal liability (e.g., funneling contracts to shell companies).

*”The law assumes transparency. If you don’t verify *who truly controls* a company, you’re accepting blind risk.”*

— China Corporate Law Specialist, Shanghai

How Due Diligence Failed (And How to Fix It)

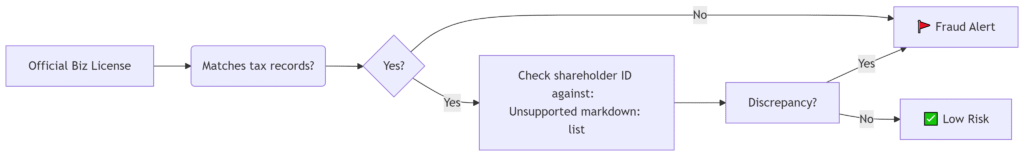

The European firm’s checks stopped at surface-level documents:

❌ Basic business license check (showed “clean” director)

❌ Standard credit report (no litigation flags)

What was missed:

✅ Shareholder depth analysis:

- Cross-referencing shareholder IDs with past company closures

- Identifying nominee patterns (e.g., one person holding 20+ directorships)

✅ UBO (Ultimate Beneficial Owner) mapping: - Tracking capital sources and related-party transactions

- Investigating supply chain links to high-risk jurisdictions

3-Step Shield Against Hidden Ownership Risks

1. Demand Full Ownership Disclosure

Under Article 40 of the 2024 Company Law, companies must disclose shareholder contribution timelines. Refusal to share this is a red flag.

2. Audit the “Human Layer”

- Verify ID cards/passports of all shareholders/directors.

- Cross-check names against public litigation databases (e.g., China Judgments Online).

3. Use Multi-Source Verification

Example from our client recovery case:

The €2M Lesson: Trust Requires Proof

The European firm’s loss wasn’t inevitable. Deep UBO due diligence would have revealed:

- The “director” was a factory worker with no machinery experience.

- The hidden owner had 3 prior supplier fraud convictions.

New Law, Higher Stakes

The 2024 Company Law empowers victims (Articles 188-192), but enforcement requires:

- Precise documentation of the controller’s role.

- Time-bound actions (e.g., 90 days to sue after discovery).

Verify Before You Wire

Hidden shareholders exploit gaps in public data. At ChinaBizInsight, we deploy forensic UBO checks combining:

- Official record cross-checks (tax, customs, IP)

- Local network investigations (factory visits, partner interviews)

- Litigation deep dives (including non-public settlements)

“We found 37% of ‘low-risk’ suppliers had undisclosed controllers. Over half posed material threats.”

— ChinaBizInsight 2023 Risk Report

Need to verify a partner? Request a confidential assessment

References:

- The Company Law of the People’s Republic of China (Revised 2023)

- Supreme People’s Court Guiding Cases on Corporate Veil Piercing (2021-2023)

- ChinaBizInsight Analysis: Undisclosed Shareholder Patterns in Export Fraud (2024)

ChinaBizInsight

Your strategic bridge to transparent business in China.