For global investors and businesses looking to enter or expand in the Chinese market, due diligence is not just a best practice—it’s a necessity. The landscape can seem complex, with layers of information to unravel. One of the most fundamental and powerful tools at your disposal is the official Chinese Business Credit Report.

Think of this report as a company’s official ID card and public health check-up, rolled into one document. Sourced directly from China’s National Enterprise Credit Information Publicity System, it’s the bedrock of corporate verification. But for those unfamiliar with its structure, it can be a dense read. This guide will walk you through each key section, explaining what it means and, more importantly, what it means for your investment or partnership decision.

What Exactly is a Chinese Business Credit Report?

Before we dive in, let’s clarify the document itself. The Chinese Business Credit Report (officially the “Enterprise Credit Information Publicity Report”) is a government-issued document. It is generated by the state-run system that all registered companies in Mainland China are legally obligated to report to. It carries official watermarks and logos, giving it significant authority.

Its primary purpose is public transparency and credit supervision. For you, the international stakeholder, it’s an unbiased starting point to verify a company’s legal existence, understand its structure, and spot potential red flags.

A Section-by-Section Breakdown for Informed Decisions

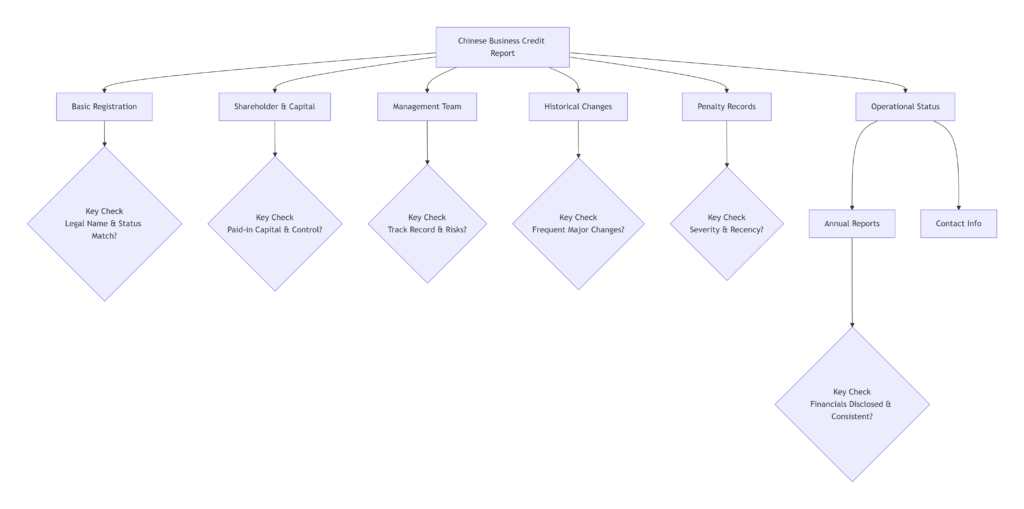

Here is a visual guide to the typical structure of a core Chinese Business Credit Report:

Let’s explore what you should look for in each of these critical sections.

1. Basic Registration Information

This is the “who are you?” section. It contains the company’s legal Chinese name, English name (if registered), Unified Social Credit Code (a unique 18-digit ID replacing older business licenses), legal representative, registered address, registered capital, founding date, business term, and approved scope of operations.

- What to Look For:

- Unified Social Credit Code: Verify it on official platforms. This code is paramount.

- Registered vs. Operational Address: Do they match the office you visit? A mismatch isn’t always a red flag but warrants inquiry.

- Business Scope: Does the company’s actual business activity fall within its legally approved scope? Operating beyond this scope is a compliance risk.

- Business Term: Is the company still within its valid operating period?

2. Shareholder & Capital Information

This section reveals the company’s ownership structure and financial backbone. It lists all shareholders (individuals or corporate entities), their contribution percentages, and, crucially, the subscribed capital (promised) vs. paid-in capital (actually deposited).

- What to Look For:

- Paid-in Capital: This is often more important than the large registered capital figure. A low paid-in ratio might indicate financial weakness or unfulfilled promises.

- Shareholder Identity: Are the shareholders individuals, other Chinese companies, or foreign entities? Identifying the ultimate beneficial owner (UBO) is key for complex structures. A corporate shareholder might require you to pull their credit report for a full picture.

- Shareholder Reputation: Are the shareholders associated with other high-risk companies?

3. Management Team: Legal Representative, Directors, Supervisors

This lists the key people: the Legal Representative (who has significant legal authority to bind the company), directors, and supervisors.

- What to Look For:

- Legal Representative: This person carries legal liability. Research if they are simultaneously the legal rep for multiple other companies (a common practice that can spread risk thin).

- Management Stability: Frequent changes in directors or supervisors can signal internal turmoil.

- Cross-Directorships: Understanding the network of companies your potential partner’s management is involved with can reveal connections and potential conflicts of interest.

4. Operational Status & Annual Reports

A critical dynamic section. It shows whether the company is in business, liquidated, or revoked. Most importantly, it provides access to its publicly filed Annual Reports.

- What to Look For:

- Annual Report Compliance: Has the company filed its report every year? Failure to do so leads to an “Abnormal Operations” listing, a major red flag.

- Disclosed Financials (within Annual Reports): From 2014 onward, companies can choose to disclose financial data like assets, revenue, and profits. Some do, many don’t. If disclosed, it’s valuable self-reported data for trend analysis. Consistency (or lack thereof) in reported figures year-over-year can be telling.

- Employee & Contact Information: Check for consistency in phone numbers and emails.

5. Historical Change Records

A chronological log of all official changes: address, registered capital, shareholders, business scope, legal representative, etc.

- What to Look For:

- Frequency and Nature of Changes: Frequent changes in core items like registered address or legal representative can indicate instability, restructuring, or even attempts to evade liabilities.

- Capital Increases/Decreases: A capital increase can signal growth and investor confidence. A significant decrease is a serious warning sign.

- M&A Activity: Changes in shareholders might indicate a recent acquisition or merger.

6. Administrative Penalty Information

One of the most vital due diligence sections. It details penalties imposed by government departments for violations in areas like market regulation, taxation, environmental protection, and customs.

- What to Look For:

- The Existence of Any Penalty: A clean record is ideal. Any penalty requires investigation.

- Severity and Recency: What was the fine amount? What was the violation? A recent, serious penalty for tax evasion or environmental mishap is a glaring risk.

- Patterns: Multiple penalties, even if small, suggest systemic compliance issues or poor management.

Other Potential Sections:

- Pledged Equity/Assets: Shows if the company’s equity or assets are used as collateral for loans, which could affect your claims.

- Intellectual Property (IP): Some basic registered trademark or patent information may be linked here, but for a full IP check, a dedicated search is recommended.

- Social Security Contributions: Indicates the number of employees enrolled in social security, which can help verify the company’s operational scale and labor compliance.

Beyond the Basics: Reading Between the Lines

A savvy investor doesn’t just read each section in isolation. The real insight comes from connecting the dots:

- Cross-reference the Legal Rep & Shareholders: Is the legal representative also a major shareholder? This is common in SMEs and indicates concentrated control.

- Compare Capital with Penalties: A company with high registered capital but a history of small fines for petty violations might be “all show, no go.”

- Timeline Analysis: Did a major shareholder exit right before a big penalty was issued? Did the business scope suddenly expand into unrelated, risky fields?

The Limits and the Next Steps

The official Business Credit Report is indispensable, but it has limits. It is a snapshot of public, legally mandated information. It may not contain in-depth financial analysis, private litigation records (only certain court judgments may appear), real-time operational risks, or supply chain data.

For significant investments, partnerships, or procurement deals, this official report should be the foundation for a deeper, customized due diligence report. Such a report would integrate the official data with financial risk analysis, comprehensive legal proceedings, in-depth background checks on key persons, news sentiment analysis, and industry benchmarking.

Understanding how to read a Chinese Business Credit Report empowers you to ask the right questions. It transforms you from a passive recipient of information into an active, discerning evaluator of Chinese business entities. In a market where trust is built on verification, this skill is not just valuable—it’s essential.