Key Takeaway: China’s revised Company Law (effective July 1, 2024) mandates shareholders to fully pay registered capital within 5 years. This transforms financial risk assessment for overseas businesses—making real capital verification critical for supply chain stability.

Why the 5-Year Rule Changes Everything

Under Article 47 of China’s new Company Law:

- All shareholders must fully pay subscribed capital within 5 years of incorporation.

- Existing companies with longer payment terms must adjust to this timeline (Transition Rules, Art. 266).

- Non-compliance triggers penalties: shareholders risk losing equity (Art. 52), and directors face liability for unpaid capital (Art. 51).

This ends the era of “nominal capital.” Companies can no longer advertise high registered capital without real financial backing.

3 Direct Risks to Your Supply Chain

1. Financial Instability

Companies with unpaid capital may lack liquidity to:

- Fulfill large orders

- Pay subcontractors

- Maintain raw material inventories

Example: A supplier claiming ¥50M capital (but only 10% paid) faces a cash crunch when scaling production.

2. Operational Disruption

Art. 53 prohibits post-incorporation capital withdrawal. Violations force shareholders to refund amounts + compensate losses. If a key supplier loses capital access:

- Production halts

- Order delays escalate

- Quality control suffers

3. Legal Contagion

Art. 88 states: Buyers of unpaid equity inherit capital obligations. If your Tier-2 supplier acquires such shares:

- Their financial strain increases

- Your indirect exposure multiplies

Financial Health Indicators Post-Reform

| Risk Signal | Low Risk | High Risk |

|---|---|---|

| Capital Paid (%) | >80% | <30% |

| Debt-to-Asset Ratio | <50% | >70% |

| Penalty History | None | Late payments, contract breaches |

Source: National Enterprise Credit Information Publicity System (mandatory disclosure under Art. 40)

How to Protect Your Business

Step 1: Verify Actual Paid Capital

- Demand Official Business Credit Reports (公示报告) showing:

- Subscribed vs. paid capital

- Payment deadlines

- Shareholder commitment history

Without this, you risk partnering with underfunded suppliers.

Step 2: Monitor Changes in Real-Time

Under Art. 40, companies must disclose:

- Capital adjustments

- Equity transfers

- Penalties

Example: A supplier reducing registered capital (Art. 224) may signal distress.

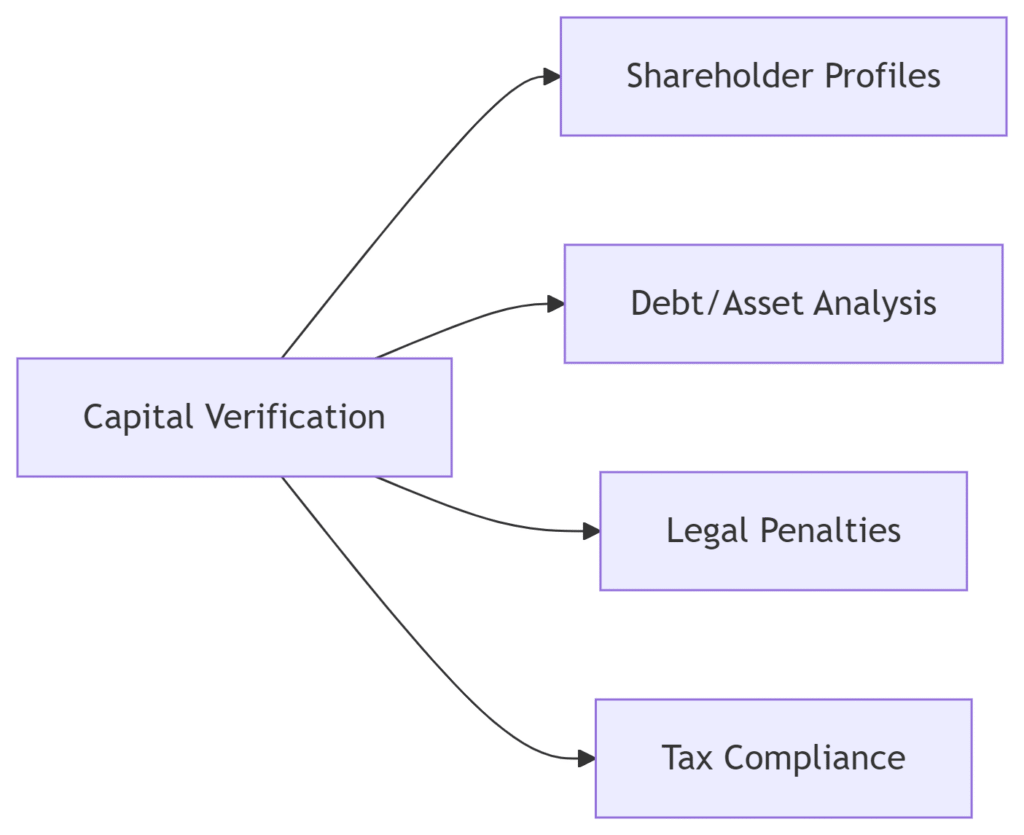

Step 3: Request Advanced Due Diligence

ChinaBizInsight’s Business Credit Report – Professional Edition covers:

This identifies suppliers at risk of:

- Equity forfeiture (Art. 52)

- Director liability claims (Art. 51)

- Liquidation (Art. 229)

The Bottom Line

The 5-year rule exposes “paper tigers” in your supply chain. Companies failing this stress test face:

✅ Liquidation (Art. 229)

✅ Equity dilution (Art. 52)

✅ Contract defaults

Proactive verification is now non-negotiable.

Verify Before You Trust

ChinaBizInsight delivers authoritative due diligence reports directly from China’s National Enterprise Credit System. Get Your Supplier’s Capital Verification Report Now →

Know your Chinese partners. Not just their promises, but their proof.

ChinaBizInsight

Your strategic bridge to transparent business in China.