If you’re a foreign investor, business owner, or trader looking at China, a massive change is unfolding in the south. On December 18, 2025, the Hainan Free Trade Port (FTP) officially initiated its island-wide customs closure operation.

This isn’t about isolating Hainan—it’s the opposite. It’s China’s most ambitious step yet to create a world-class, high-level free trade zone. Think of it as transforming the entire tropical island into a special customs territory with unique, business-friendly rules.

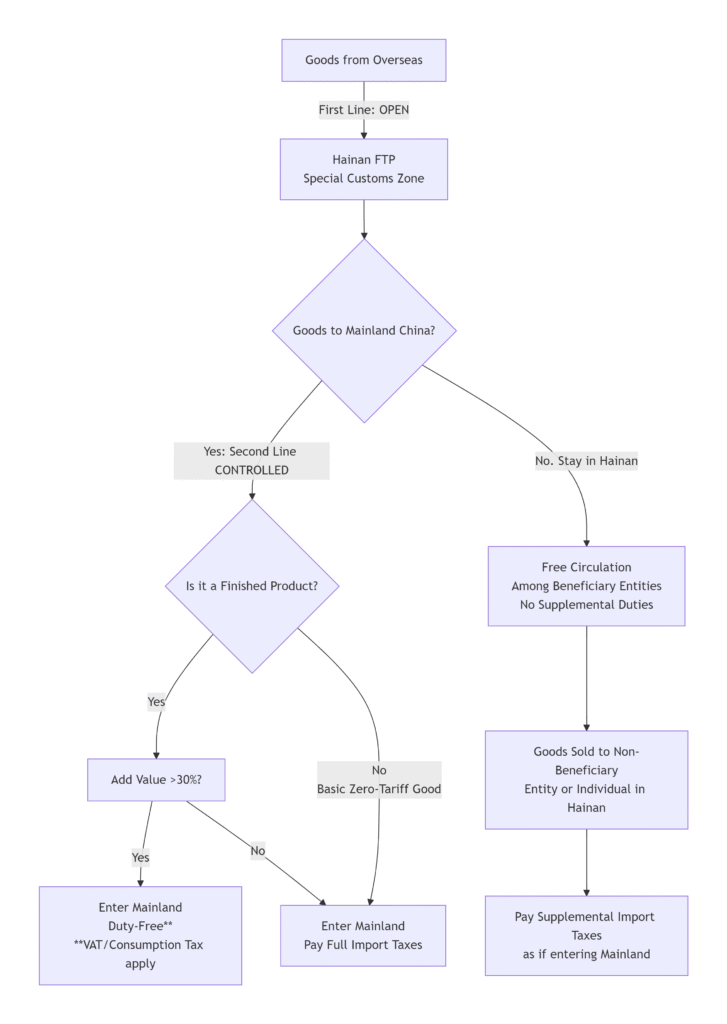

But what does “customs closure” actually mean? And more importantly, how does the core principle of “First-Line Opening, Second-Line Control, Free Flow Within the Island” create tangible opportunities—and new considerations—for your international business?

Let’s break it down in plain English.

What Exactly Is “Island-Wide Customs Closure”?

Simply put, “closure” refers to establishing the whole of Hainan Island as a special customs supervision area. The island’s geographical borders become key regulatory lines:

- The “First Line”: This is Hainan’s border with the rest of the world (overseas countries and regions, including Hong Kong, Macao, and Taiwan). The policy here is “Opening”—aiming for maximum freedom and convenience for goods and elements entering from abroad.

- The “Second Line”: This is the boundary between Hainan and Mainland China. The policy here is “Control”—ensuring regulated management for goods flowing from Hainan into the domestic Chinese market.

- Free Flow Within the Island: Inside Hainan, goods, capital, and people are meant to move with minimal restrictions, fostering a vibrant internal market.

In essence, Hainan is becoming a “in-country, out-of-customs” zone. It’s physically part of China, but for customs purposes, it operates under a distinct, liberalized regime for international trade.

Decoding the “First-Line Opening”: Your Gateway to Zero-Tariff Benefits

The “opening” at the first line is where the most significant benefits kick in, centered around a dramatically expanded Zero-Tariff policy.

1. The Negative List System

Instead of a positive list of what gets zero tariffs, Hainan now uses a negative list called the Import Taxable Goods Catalogue. Only goods on this list are subject to regular import duties when entering Hainan from overseas. Everything else enjoys exemption from import关税, import VAT, and consumption tax.

The Scale: The zero-tariff coverage has exploded from covering 21% of tariff lines pre-closure to about 74% post-closure. That’s roughly 6,600 items, spanning machinery, raw materials, components, and consumer goods. For businesses, this can mean around 20% savings on imported equipment costs.

2. Who Can Benefit? The “Beneficiary Entities”

Not everyone automatically gets zero-tariff imports. The privilege is granted to “Beneficiary Entities” (享惠主体). These include:

- Enterprises registered in Hainan with independent legal person status.

- Institutions like schools and hospitals.

- Specific tech and education-focused non-enterprise units.

The list of Beneficiary Entities is dynamic, determined by the Hainan provincial government. This is a crucial piece of information for any foreign business looking to partner with or invest in a Hainan entity—verifying their status is key.

3. Special Rules for Key Assets

- Vehicles, Vessels, Aircraft & Yachts: Eligible enterprises in transport and tourism can import these duty-free for operational use. However, they must be registered in Hainan and operate under specific rules (e.g., aircraft must use Hainan as a main base).

- A Notable Rule for Vehicles: Zero-tariff vehicles can conduct passenger/cargo runs between Hainan and the mainland, provided at least one end of the trip is in Hainan. Their cumulative stay on the mainland is capped at 120 days per year (with exceptions for direct round trips).

Understanding the “Second-Line Control”: Entering the Mainland Chinese Market

This is the critical control mechanism. Zero-tariff goods entering Hainan freely cannot flood the mainland market without following rules.

- General Rule: When a Zero-Tariff good or its finished product (made from zero-tariff materials) is sold from Hainan into mainland China (“crossing the second line”), the Beneficiary Entity must pay the import duties, VAT, and consumption tax that were originally exempted.

- The Golden Exception: Processing Value-Added Policy This is a game-changer for manufacturing in Hainan. If a Hainan-based encouraged-industry enterprise processes imported zero-tariff materials and the added value exceeds 30%, the finished product can enter the mainland DUTY-FREE. Only import VAT and consumption tax apply.

- Formula: (Domestic Sales Price – Value of Imported Materials – Value of Domestically Sourced Materials) / (Value of Imported + Domestic Materials) ≥ 30%.

- This policy incentivizes substantial manufacturing and value creation within Hainan, turning it into a potential export platform to the vast Chinese market.

Visual Guide: The Flow of Goods under Hainan’s New System

What This Means for Foreign Businesses: Opportunities & Imperatives

Major Opportunities:

- Cost-Competitive Sourcing & Manufacturing: Import machinery, raw materials, and components at significantly lower costs. Establish production lines where adding >30% value grants privileged access to the mainland market.

- Regional Headquarters & Logistics Hub: Use Hainan as a base for sourcing, light assembly, and distribution for both the island’s growing market and the wider Asia-Pacific region, leveraging its free flow and connectivity.

- Access to High-End Services: The push for internationalization brings world-class education, healthcare, and professional services to Hainan, improving quality of life for expatriate staff and managers.

- Consumer Market Access: While individual zero-tariff car purchases aren’t permitted, the broad zero-tariff and relaxed duty-free shopping policies (now covering 74% of categories) indicate a booming, high-spending consumer retail environment.

Critical Compliance & Due Diligence Points:

- Verify “Beneficiary Entity” Status: Before signing joint-venture agreements or large supply contracts with Hainan entities, confirm their official status as a Beneficiary Entity eligible for zero-tariff imports. This status can change.

- Understand Product-Specific Rules: The Import Taxable Goods Catalogue and the List of Prohibited and Restricted Goods are fundamental. Always check if your product is on the negative list or faces special trade remedy measures.

- Track the Supply Chain & Value Addition: If aiming for the 30%加工增值 (Processing Value-Added) exemption, robust systems to track imported material value, production costs, and final sale price are essential for customs compliance.

- Monitor Operational Rules for Assets: If involving zero-tariff vehicles or vessels, strict adherence to operational scope and mainland stay limits is required to avoid penalties and back taxes.

The Hainan FTP is a bold experiment in trade liberalization. For the savvy international business, it offers a unique sandbox with lower barriers to import and a potential springboard into China. However, its special status comes with a unique and complex set of rules.

Navigating this new landscape requires more than just reading the headlines. It demands a thorough understanding of your potential partners’ standing, the precise regulations governing your goods, and the ongoing compliance requirements. This is where in-depth, reliable business intelligence becomes not just useful, but essential. Conducting comprehensive due diligence, such as obtaining official enterprise credit reports and verifying regulatory filings, is a critical first step to de-risking your Hainan venture and building a solid foundation for success.

Ready to explore partnerships in Hainan? Understanding your potential Chinese partner is the first and most crucial step. Consider a Professional Enterprise Credit Report to gain deep insights into their legitimacy, financial health, and operational status.

Useful Official Document Downloads:

- Notice on Tax Policies for Goods Entering/Exiting the “First Line,” “Second Line,” and Circulating Within Hainan FTP (Ministry of Finance, GACC, SAT – Cai Guanshui [2025] No. 12)

- Hainan Free Trade Port Import Taxable Goods Catalogue (Cai Guanshui [2025] No. 13)

- Hainan Free Trade Port List of Prohibited and Restricted Import/Export Goods and Items (MOFCOM Announcement [2025] No. 43)

ChinaBizInsight

Your strategic bridge to transparent business in China.