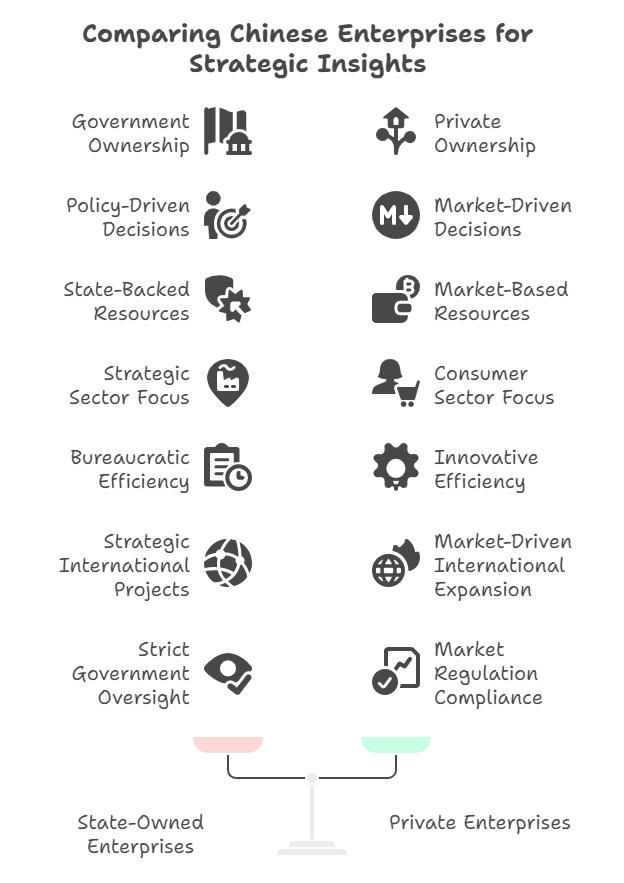

When it comes to doing business in China, understanding the landscape of Chinese companies is crucial. Two major types of enterprises dominate the market: Private Enterprises (民营企业) and State-Owned Enterprises (SOEs, 国有企业). While both play significant roles in China’s economy, they operate under very different structures, goals, and regulatory environments.

For international investors, partners, or anyone looking to engage with Chinese businesses, knowing these differences isn’t just useful—it’s essential for making informed decisions, mitigating risks, and identifying the right partners.

In this article, we’ll break down the key differences between Chinese private enterprises and state-owned enterprises, covering their ownership, governance, operational flexibility, market roles, and more. We’ll also provide insights into how you can conduct due diligence on either type of company to ensure a secure and successful business relationship.

1. Ownership and Control

State-Owned Enterprises (SOEs)

SOEs are wholly or majority-owned by the Chinese government. They are often involved in strategic sectors such as energy, telecommunications, finance, and infrastructure. The state exercises control through ownership and appoints key management personnel.

Private Enterprises

Private enterprises are owned by individuals, families, or private institutional investors. They operate with greater autonomy and are driven by market competition and profit motives.

2. Governance and Decision-Making

SOEs

SOEs often have complex governance structures with strong government influence. Their strategic decisions may align with national policies rather than purely commercial interests.

Private Enterprises

Private companies tend to have more streamlined decision-making processes. They are agile, responsive to market changes, and focused on innovation and efficiency.

3. Access to Resources

SOEs

SOEs typically enjoy better access to financing, land, licenses, and policy support. They often receive state-backed loans and subsidies.

Private Enterprises

Private enterprises rely more on market-based financing, such as bank loans, private equity, or IPO fundraising. They face more competition but are often more innovative.

4. Market Role and Sector Focus

SOEs

SOEs dominate sectors deemed vital to national security and public welfare, such as:

- Oil and gas

- Electricity

- Railways

- Banking and insurance

Private Enterprises

Private enterprises are more common in consumer goods, technology, e-commerce, manufacturing, and services. Companies like Huawei, Alibaba, Tencent, and BYD are iconic examples.

5. Performance and Efficiency

SOEs

While SOEs are often large and stable, they may suffer from bureaucracy, overstaffing, and lower efficiency due to less competitive pressure.

Private Enterprises

Private firms are generally more efficient, customer-focused, and quicker to adapt to market trends. They are major drivers of China’s innovation and export economy.

6. International Presence

SOEs

SOEs often engage in large-scale international projects, such as Belt and Road Initiative (BRI) infrastructure projects. They represent China’s strategic interests abroad.

Private Enterprises

Private companies expand globally through market-driven strategies, such as cross-border e-commerce, technology exports, and overseas investments.

7. Regulatory and Compliance Environment

SOEs

SOEs are subject to stricter government oversight and auditing. Their operations are closely tied to national policies.

Private Enterprises

Private companies face fewer direct government controls but must comply with market regulations, tax laws, and commercial standards.

Why This Matters for International Businesses

Whether you’re sourcing suppliers, investing, or forming joint ventures, understanding whether you’re dealing with an SOE or a private enterprise can help you:

- Assess risk and stability

- Understand decision-making speed

- Evaluate corporate culture and flexibility

- Gauge alignment with your business goals

For instance, partnering with an SOE may offer stability and policy support but slower processes. Working with a private company may mean more agility but less state backing.

How to Verify Chinese Company Information

Before engaging with any Chinese company, it’s essential to conduct due diligence. Here are some key documents and reports you may need:

- Business License (营业执照)

- Enterprise Credit Report (企业信用报告)

- Shareholder and Director Information

- Financial Statements (财报)

- Patent and Trademark Records

- Legal and Risk Reports

These documents can help you verify the company’s legitimacy, financial health, and operational status.

For example, you can use our Official Enterprise Credit Report to get a comprehensive view of a company’s official registration and credit status.

Download the 2025 China Top 500 Private Enterprises List

To help you identify leading private enterprises in China, we’ve compiled the 2025 China Top 500 Private Enterprises List, based on annual revenue and official data.

This list includes companies like JD.com, Alibaba, Huawei, BYD, Tencent, and many others that are shaping the future of China’s economy.

Conclusion

Both SOEs and private enterprises are integral to China’s economic ecosystem. SOEs offer stability and scale, while private enterprises bring innovation and flexibility. Understanding these differences will help you navigate the Chinese business environment more effectively.

If you’re planning to partner with a Chinese company, consider conducting thorough due diligence to avoid risks and ensure a successful collaboration. We at ChinaBizInsight specialize in providing reliable company reports, verification services, and legal authentication for international clients.

Feel free to contact us for a customized due diligence report or any questions about Chinese business intelligence.

ChinaBizInsight

Your strategic bridge to transparent business in China.