Picture this: A cargo ship arrives at Hong Kong’s bustling port. Before unloading, it’s arrested by court order. Why? Three creditors claim competing rights to the vessel. The bank holds the first mortgage. A repair yard claims unpaid service fees. Crew members demand months of back wages. Who gets paid first? The answer isn’t straightforward—it depends on invisible legal hierarchies governing maritime liens. For financial institutions financing vessels, this represents a trillion-dollar blind spot in global shipping finance.

The Anatomy of Maritime Liens vs. Mortgages

Maritime liens are unique legal creatures. Unlike mortgages registered publicly through systems like Hong Kong’s Ships Registry, maritime liens arise automatically from specific events:

- Crew wage claims

- Salvage operations saving vessels from peril

- Collision damages caused by the vessel

- Repairer’s necessaries (essential services keeping the ship operational)

These “secret liens” attach to the vessel itself, traveling with it globally. Ship mortgages, conversely, are contractual security interests formally recorded in registries. Hong Kong follows strict registration protocols under the Merchant Shipping (Registration) Ordinance (Cap. 415), prioritizing mortgages based on registration timing. But maritime liens shatter this orderly system—they jump the queue.

Hong Kong vs. Global Priority Rules: A Legal Minefield

Hong Kong’s approach blends colonial heritage with modern pragmatism. Under the High Court Ordinance (Cap. 4), its Admiralty Court follows this payment cascade when auctioning vessels:

- Court sale costs (including arrest fees)

- Maritime liens in this order:

- Salvage claims (newest to oldest)

- Damage claims from collisions

- Seafarer wages

- Master’s wages and disbursements

- Repairs/necessaries supplied in Hong Kong

- Registered mortgages (by registration date)

- Statutory liens (e.g., port dues)

- Unsecured creditors

Compare this with U.S. law, where repairer’s liens often rank above mortgages, or the UK where salvage always leads. These differences create enforcement chaos. In 2021, the container ship MSC Joanna was arrested in Hong Kong by bunker suppliers. Though their claim ranked low locally, they leveraged New York’s lien-friendly laws to force a global settlement—a tactic called “forum shopping.”

Case Study: The $20M Creditor Crossfire (Hong Kong, 2023)

A real-world clash unfolded when chemical tanker Ocean Pioneer faced arrest. Three claims emerged:

| Claimant | Amount | Claim Type | Jurisdiction of Action |

|---|---|---|---|

| Bank A | $12M | 1st Mortgage | Hong Kong |

| Salvage Co. | $5M | Salvage lien | Singapore |

| Crew | $3M | Wage lien | Hong Kong |

Under Hong Kong rules, the crew ($3M) and salvage ($5M) would rank above Bank A’s mortgage. But the salvors sued in Singapore, where their claim held absolute priority. The bank faced a 60% loss until it negotiated a side deal with the salvors. This “creditor diplomacy” cost $1.2M in concessions—all preventable with proper lien mapping.

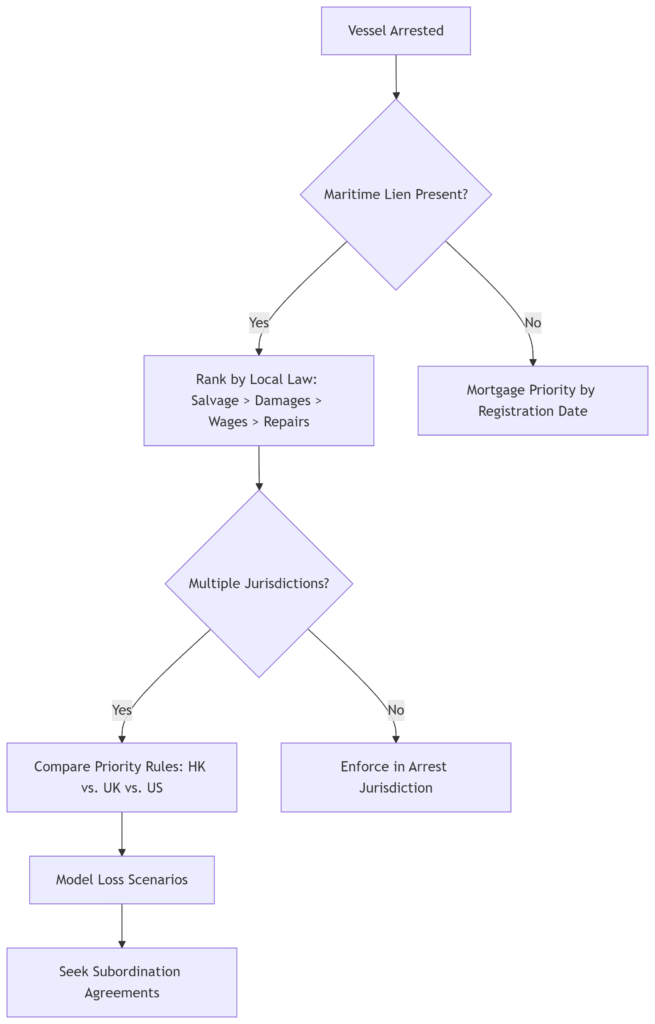

Your Priority Decision Roadmap

Use this action framework to navigate claims:

3 Hidden Risk Indicators for Ship Lenders

Beyond standard credit checks, monitor:

- Crew Payment Histories: Late wages create liens that leapfrog mortgages. Our executive risk reports track payroll disputes across fleets.

- Port of Refuge Stops: Unscheduled diversions often signal unreported salvage incidents.

- Jurisdiction Hopping: Vessels frequently docking in lien-friendly ports (US, South Africa) heighten risk.

The Winning Strategy: Lien Intelligence > Collateral

When the Glory Seas was auctioned in Hong Kong last year, the winning bidder wasn’t a bank—it was a hedge fund that bought junior mortgages cheaply. Their edge? They’d identified a crew wage lien about to expire, elevating their position. In maritime finance, the real asset isn’t the ship—it’s the invisible map of claims layered upon it.

For financiers, comprehensive due diligence is non-negotiable. Traditional credit reports miss latent liens. Vessel-specific verification—from crew contracts to port logs—is essential. In high-stakes waters where maritime liens lurk beneath the surface, the victors are those who illuminate the depths.

ChinaBizInsight

Your strategic bridge to transparent business in China.