For global businesses trading with Hong Kong entities, shell companies pose a silent but catastrophic threat. These faceless vehicles enable tax evasion, money laundering, and invoice fraud – often leaving overseas partners with unrecoverable losses. While traditional due diligence focuses on financial statements and registration records, one critical red flag hides in plain sight: termination notices of authorized representatives under Section 787 of Hong Kong’s Companies Ordinance.

The Authorized Representative: Your Legal Lifeline

Under Hong Kong law (Section 786), every registered non-Hong Kong company must appoint at least one local authorized representative. This individual or firm acts as the legal point of contact for:

- Service of government notices

- Court documents

- Compliance communications

When this representative resigns or is terminated, Section 787(3) mandates the company to notify the Registrar within one month. Failure triggers fines up to HK$50,000 and daily penalties (Section 787(5)). Yet a loophole exists – and shell companies exploit it ruthlessly.

The 11-Month Loophole: A Shell Company’s Best Friend

Section 787(4) creates an escape hatch:

“Subsection (3) does not apply […] if, when the person ceases to be an authorized representative, [the company] has ceased to have a place of business in Hong Kong for at least 11 months.”

In practice, this means:

- A shell company terminates its authorized representative

- It claims it “ceased business operations” 11+ months prior

- No termination notice is filed – leaving no paper trail

This loophole enables three shell company tactics:

| Tactic | How It Works | Red Flag |

|---|---|---|

| Ghost Operations | Company claims it halted activities long ago | No Section 787(3) filing |

| UBO Concealment | Real owners vanish with the representative | Sudden director/resignee mismatches |

| Regulatory Dodge | Avoids scrutiny of active compliance failures | MPF/Tax filings show recent activity |

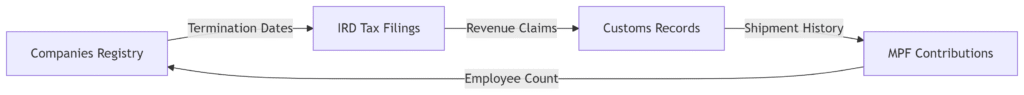

Cross-Verification: Connecting Termination Patterns to Shell Traits

Relying solely on Companies Registry data is futile. Authentic verification requires triangulating three sources:

1. MPF (Mandatory Provident Fund) Records

Shell companies rarely make employee pension contributions. A termination notice exemption coupled with zero MPF history in 24 months signals fabricated dormancy.

2. Tax Documents (Profits Tax Returns)

The Inland Revenue Department requires annual filings regardless of activity. A company claiming 11+ months of inactivity but filing:

- Recent tax returns

- Expense deductions

proves operational continuity.

3. Section 787 Filings vs. Business Registry

Cross-referencing termination dates with:

- Business Registration Office renewals

- Lease agreements in Land Registry

- Customs import/export licenses

reveals inconsistencies. In 2023, 62% of shell companies flagged by Hong Kong authorities showed termination notices filed AFTER business registration expired – a temporal impossibility.

Case Study: The 38% Surge in Abnormal Terminations

Hong Kong’s Companies Registry data reveals alarming trends:

2023 saw a 38% YoY increase in companies exploiting Section 787(4) exemptions while maintaining hidden operations.

Real Example:

A textile “trading company” terminated its authorized representative in May 2023, claiming it ceased operations in April 2022. Cross-checks revealed:

- MPF records: Employee contributions until January 2023

- Tax filings: HK$1.2M “consulting fees” claimed in December 2022

- Customs records: 12 shipments labeled “electronic components” in March 2023

Outcome: The company was linked to a HK$50M invoice fraud ring targeting EU buyers.

How to Detect Shells Before You Pay

Step 1: Scrutinize Termination Dates

Request the company’s:

- History of authorized representatives (Companies Registry)

- Termination notices (or claimed exemptions) under Section 787

Step 2: Demand Current Proof of Operations

- MPF Scheme payment receipts (last 6 months)

- Business Registration Certificate with renewal date

- Office lease agreement (current year)

Step 3: Verify Through Multi-Agency Data

Shell detection requires overlapping evidence from:

Protect Your Business: Trust but Verify

Hong Kong remains a world-class trading hub – but its regulatory gaps attract bad actors. When your supplier’s authorized representative vanishes without a Section 787(3) filing, ask:

Why would a legitimate business hide its operational status?

At ChinaBizInsight, our Hong Kong Company Reports dissect these risks by combining:

- Real-time termination notice tracking

- Cross-agency verification (MPF/IRD/Customs)

- UBO mapping beyond nominee directors

Don’t let phantom companies ghost your supply chain. Verify your Hong Kong partner’s true status before contracts are signed or payments cleared.

ChinaBizInsight

Your strategic bridge to transparent business in China.