When evaluating the financial health of a Hong Kong company, traditional credit reports often focus on balance sheets and profit metrics. But there’s an underutilized tool that offers unparalleled insights: the Company Charge Register under Section 634 of Hong Kong’s Companies Ordinance. This public record reveals hidden liabilities, secured debts, and asset encumbrances—critical data for credit risk assessment. For global investors, lenders, or partners, ignoring this resource is like navigating a minefield blindfolded.

What Is the Charge Register? Decoding Section 634

Under Hong Kong law, companies must maintain a statutory Register of Charges (often called the “Charge Register”). Key features include:

- Legal Basis: Mandated by Sections 335–339 of the Companies Ordinance (Cap. 622).

- Content: Records all secured liabilities, such as:

- Mortgages over property.

- Floating charges on assets (e.g., inventory or receivables).

- Debentures and loan securities.

- Transparency: Publicly accessible via the Hong Kong Companies Registry.

💡 Why Section 634 Matters: It explicitly prohibits noting “trusts” in member registers (e.g., shareholdings), redirecting scrutiny to the Charge Register for debt-related risks.

4 Ways Charge Data Uncovers Credit Risks

- Debt Burdens Revealed

- A company with multiple floating charges may signal cash-flow problems. For example, repeated charges against inventory could indicate liquidity crises.

- Red Flag: New charges filed shortly after loan repayments suggest “debt stacking.”

- Asset Encumbrance Ratios

- Calculate: Encumbered Assets ÷ Total Assets.

- High ratios (>40%) mean fewer unpledged assets to cover debts if bankruptcy occurs.

- Creditor Hierarchy Insights

- Charges are ranked by registration date. Earlier charges have priority in insolvency.

- If a company’s assets are pledged to 5+ lenders, newer creditors face higher recovery risks.

- Patterns of Financial Stress

- Case Study: A trading firm registered 3 floating charges in 6 months. Later, it defaulted on supplier payments. The Charge Register provided early warnings missed by audited reports.

How to Access and Interpret Charge Registers

- Public Search:

- Visit the e-Search Portal of the Companies Registry.

- Search by company name/ID, then request the “Register of Charges” (fee: HK$160).

- Key Data Points: Field Risk Insight Charge Date Frequency indicates financial distress. Charge Holder Bank vs. private lender (higher risk). Assets Secured Core assets (e.g., property) vs. inventory. Amount Secured Debt scale relative to company equity.

- Limitations:

- Charges must be registered within 1 month of creation. Delays imply compliance issues.

- Offshore assets may not appear.

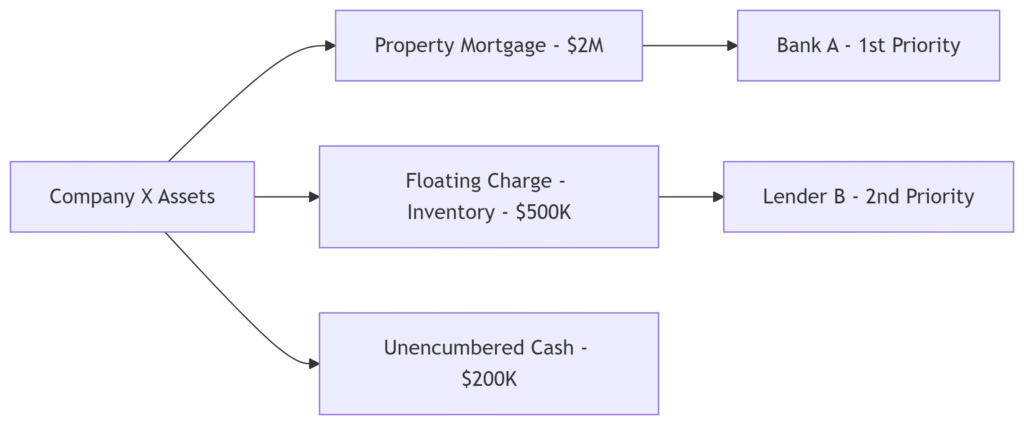

Visualizing Risk: A Real-World Framework

Consider this asset-debt mapping for “Company X”:

Analysis:

- Only $200K (10%) of assets are unpledged.

- If liquidated, Lender B recovers $0 until Bank A is paid.

Why This Outperforms Standard Credit Reports

Traditional reports miss real-time debt registrations. The Charge Register offers:

✅ Timeliness: Updated within 30 days of charge creation.

✅ Objectivity: Legal filings > self-reported financials.

✅ Predictive Power: Rising charge volume correlates with default risk (per HKMA studies).

For due diligence, combine this with:

- Director Risk Reports (e.g., Executive Risk Profiles) to cross-check personal guarantees.

- Official Enterprise Credit Reports for holistic analysis.

Practical Tips for Global Stakeholders

- Monitor Key Events:

- New charges filed post-loan agreements.

- Amendments to existing charges (e.g., increased amounts).

- Use Professional Services:

- Non-Chinese speakers or time-constrained firms can leverage HK Company Document Retrieval for certified charge registers.

- Cross-Border Context:

- Compare HK charge data with mainland China’s Credit Reference System for subsidiaries.

Conclusion: Turn Hidden Liabilities into Strategic Insights

Hong Kong’s Charge Register is a credit risk “X-ray”—revealing structural vulnerabilities invisible in profit statements. For foreign investors, this data isn’t just due diligence; it’s a strategic advantage. By integrating charge analysis with broader credit assessments, businesses can avoid toxic partnerships and spot recovery opportunities in distressed assets.

🔍 Ready to uncover hidden risks? Access certified Charge Registers and credit reports via our Hong Kong Company Services.

ChinaBizInsight

Your strategic bridge to transparent business in China.