Introduction

For global investors, lenders, and business partners, verifying the ownership structure of a Hong Kong company is a critical step in mitigating risk. The shareholder register provides definitive proof of who holds equity, influences decisions, and ultimately controls an entity. Hong Kong law provides clear but regulated pathways to access this vital information. Understanding the legal framework under the Hong Kong Companies Ordinance (Cap. 622) is essential for conducting due diligence without crossing legal boundaries.

The Legal Foundation: Section 631 Explained

The cornerstone of shareholder register access is Section 631 of the Hong Kong Companies Ordinance. This provision establishes a tiered access system:

- Members (Shareholders): Have an absolute right to inspect the register and index of members free of charge. They must submit a request “in the prescribed manner” (typically in writing to the company’s registered office).

- Any Other Person: Can inspect the register and index upon request and payment of a prescribed fee. The company must comply if the request follows the statutory procedure.

- Copies: Both members and others can request copies of the register (or parts of it) for a fee.

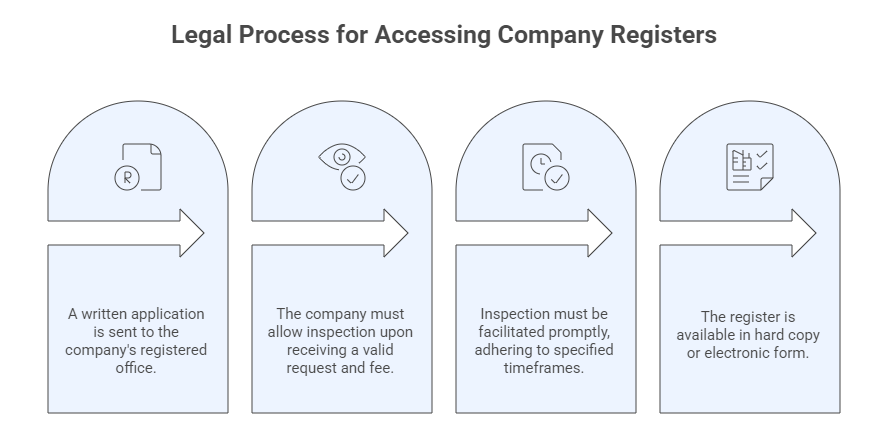

The Process: How to Legally Request Access

Access isn’t automatic upon request. Companies must follow specific procedures, often detailed in regulations supplementing the Ordinance:

- Submit a Formal Request: A written application must be sent to the company’s registered office, clearly stating the purpose (though the company’s right to challenge purpose is limited under Section 631).

- Company’s Obligation: Upon receiving a valid request and any required fee, the company must allow inspection in accordance with regulations. This typically means during normal business hours at the registered office or the location where the register is kept (as notified to the Companies Registry under Section 628).

- Timeframe: The company must facilitate inspection promptly. Regulations may specify allowable timeframes.

- Form of Inspection: The register might be available in hard copy or electronic form. If electronic, the company must provide a legible hard copy printout or supervised electronic access (Section 655).

Legitimate Reasons for Access (Use Cases)

Investors leverage shareholder registers for crucial activities:

- Due Diligence: Verifying ownership before investments, loans, or major contracts.

- M&A Activity: Identifying major shareholders during potential acquisitions.

- Shareholder Activism: Contacting fellow shareholders regarding corporate actions or governance concerns.

- Debt Recovery: Identifying asset owners in enforcement proceedings.

- Regulatory Compliance: Fulfilling KYC (Know Your Customer) and AML (Anti-Money Laundering) obligations.

The Critical Protection: Section 644

While transparency is important, the law balances this with privacy rights, particularly for directors. Section 644 empowers companies to withhold specific sensitive information from anyone inspecting the register or requesting a copy, regardless of their status (member or public):

- Protected Information:

- The usual residential address of a director or reserve director.

- The full identification number (HKID or passport number) of a director or reserve director.

- How Protection Works: Companies can simply omit this information from the version of the register presented for inspection or copying. Only the director’s correspondence address (which cannot be a PO Box) must be visible.

- Rationale: This prevents misuse of highly personal data, protecting individuals from harassment, identity theft, or security risks.

Risks of Unauthorized Access & Legal Consequences

Attempting to access the shareholder register outside the Section 631 framework or seeking protected information under Section 644 is illegal and carries significant risks:

- Civil Liability: Individuals or entities harmed by unauthorized access or misuse of information could sue for damages (e.g., invasion of privacy, breach of confidence).

- Criminal Prosecution: While the Ordinance primarily penalizes the company for failing to comply with access rules, obtaining information through deception (like posing as a member) could potentially lead to charges like fraud or access to computer with criminal intent under other Hong Kong laws.

- Reputational Damage: For businesses, being caught engaging in or commissioning illegal access severely damages credibility and trust with partners and regulators.

- Invalidity of Actions: Due diligence or decisions based on illegally obtained information could be legally challenged.

Practical Challenges & Overcoming Them

Even with legal rights, investors often face hurdles:

- Locating the Register: While companies must notify the Registry of the register’s location (Section 628), this information might not be instantly accessible. Searching the Companies Registry’s Integrated Companies Registry Information System (ICRIS) is the first step to find the registered office address.

- Company Non-Compliance: A company might wrongfully refuse a valid request or delay access. Section 633 provides a remedy: an application can be made to the Court of First Instance to compel inspection or rectify the register if information is incorrect or omitted.

- Interpreting Complex Structures: Shareholder registers list legal owners. Identifying ultimate beneficial owners (UBOs) behind nominee arrangements or complex corporate structures requires deeper investigation and expertise. This is where professional due diligence reports become invaluable.

- “Closed” Registers: Companies can close the register for up to 30 days per year (extendable to 60 days by member resolution) under Section 632 (e.g., before an AGM). If closed upon request, the company must provide a certificate stating the closure period and authority.

Best Practices for Investors

- Always Use Legal Channels: Strictly follow the Section 631 procedure. Document your requests.

- Respect Privacy: Understand that certain director details (S.644) are legitimately protected. Focus on the shareholder information you are entitled to see.

- Seek Professional Help: Navigating requests, interpreting register data, and conducting thorough due diligence (especially for UBOs) can be complex. Engaging a reputable corporate services provider like ChinaBizInsight ensures compliance and delivers deeper insights through comprehensive Hong Kong Company Reports that legally consolidate and analyze crucial data points beyond just the register.

- Verify with Registry Filings: Cross-reference the shareholder information with the company’s latest Annual Return (Form NAR1) filed at the Companies Registry, accessible via ICRIS (for a fee).

Conclusion

Hong Kong’s legal framework, particularly Sections 631-634 and 644, provides a clear, albeit regulated, path for legitimate access to company shareholder registers. Understanding these provisions – the rights of inspection, the protection of sensitive director information, the procedures to follow, and the legal consequences of non-compliance – is fundamental for any investor or business engaging with Hong Kong entities. While the register is a vital tool, accessing it legally and ethically is paramount. For complex situations or to gain a holistic view of a company’s health and ownership, partnering with experts ensures thorough, compliant due diligence, empowering you to make informed decisions with confidence in the dynamic Hong Kong market.

ChinaBizInsight

Your strategic bridge to transparent business in China.