Introduction

In cross-border mergers and acquisitions, undisclosed conflicts of interest can derail deals, trigger financial losses, and expose businesses to regulatory penalties. A critical blind spot? Related party transactions (RPTs) involving directors of Hong Kong companies. Under Sections 536–538 of Hong Kong’s Companies Ordinance, directors must declare material interests in transactions, yet gaps in due diligence often let risks slip through. This guide reveals how leveraging the Hong Kong Companies Registry can unmask hidden RPTs and fortify your due diligence.

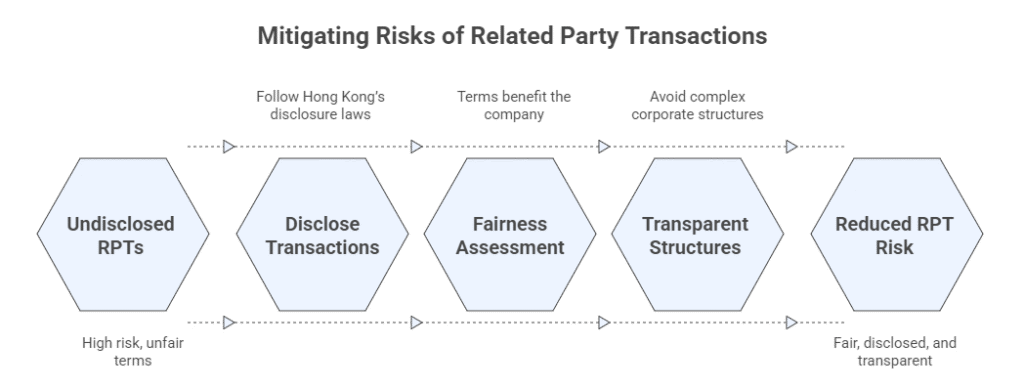

The Hidden Threat: Why RPTs Demand Scrutiny

Related party transactions occur when a company engages in deals with entities linked to its directors (e.g., family members, controlled firms, or trusts). While not inherently illegal, they become high-risk when:

- Undisclosed: Violating Hong Kong’s disclosure laws (Sections 536–538).

- Unfair: Terms favor insiders at the company’s expense (e.g., inflated contracts, asset transfers).

- Concealed: Buried in complex corporate structures to evade detection.

Real-world impact: In 2022, a multinational firm lost $12M post-acquisition after discovering an undisclosed RPT where a target company’s director sold overvalued assets to a sibling-owned entity. The transaction escaped notice due to inadequate registry checks.

The Legal Framework: Sections 536–538 Decoded

Hong Kong mandates strict transparency to combat RPT risks:

- Declaration Duty (Sec. 536):

- Directors must disclose material interests in company transactions (e.g., equity stakes, loans, or contracts).

- “Material” = significant enough to influence business decisions (e.g., transactions exceeding 5% of net assets).

- Applies to shadow directors (de facto controllers) and connected entities (family, trusts, or firms under director influence).

- Disclosure Mechanics (Sec. 537–538):

- Written declarations must detail the nature/extent of interests.

- Timeline: Declarations for proposed deals must precede signing; existing deals require “as soon as practicable” disclosure.

- Public access: Declarations filed with the Hong Kong Companies Registry are publicly searchable.

⚠️ Non-compliance: Fines up to HK$100,000 (Sec. 542). Voidable transactions and director liability for losses (Sec. 513).

Detecting RPTs: A Step-by-Step Registry Guide

The Hong Kong Companies Registry (cr.gov.hk) is your frontline tool. Here’s how to mine it for RPT red flags:

Step 1: Identify Directors & Shadow Directors

- Pull the Company Particulars Report (via Registry e-Search).

- Key fields: Directors’ names, IDs, appointment dates.

- Pro tip: Cross-reference with “alternate directors” (Sec. 478) who may act on behalf of hidden controllers.

Step 2: Map Connected Entities

Under Sec. 486, “connected entities” include:

- Family members (spouse, children under 18).

- Companies where the director holds >30% voting rights.

- Trusts/partnerships benefiting the director.

- Action: Retrieve the Register of Directors’ Interests (mandatory for public companies). Scrutinize filings for undisclosed links.

Step 3: Analyze Transaction Patterns

Compare registry data against financial statements:

- Overpriced contracts with entities named in directors’ declarations.

- Recurring deals with low-revenue firms linked to directors.

- Loans/guarantees to connected parties (Sec. 500–504).

🔍 Case Study: A due diligence team found a Hong Kong distributor paying 40% above market rate to a supplier. The registry revealed the supplier was owned by the distributor’s CEO’s spouse—an undeclared RPT.

Limitations & Complementary Tactics

While the registry is powerful, it has gaps:

- Private companies: Lesser disclosure requirements vs. public firms.

- Timeliness: Filings lag real-time deals.

- Obfuscation: Complex ownership chains (e.g., offshore trusts).

Strengthen your checks with:

- On-site audits: Validate physical operations and third-party contracts.

- Financial forensics: Trace unusual payment flows via bank statements.

- AI-powered tools: Monitor real-time company network changes.

Why Expertise Matters in RPT Due Diligence

Navigating Hong Kong’s registry demands local legal fluency and investigative precision. For instance:

- Sec. 538 “general notices”: Directors may file blanket declarations (e.g., “interested in all deals with Firm X”), requiring deeper scrutiny of transaction-specific fairness.

- Cross-border complexities: Entities in Mainland China or SARs (Macau/Taiwan) add layering challenges.

💡 Solution: Partner with specialists who combine registry access, legal analysis, and cross-jurisdictional intelligence.

Conclusion: Turn Transparency into a Strategic Shield

Hong Kong’s registry is a goldmine for RPT detection—but only if wielded skillfully. By systematically applying Sections 536–538, investors can transform regulatory disclosures into a shield against conflicts of interest. In an era where 63% of M&A failures stem from due diligence oversights (Harvard Business Review, 2023), mastering this tool isn’t optional; it’s essential.

Ready to eliminate blind spots? Explore our deep-due diligence solutions:

ChinaBizInsight

Your strategic bridge to transparent business in China.