Hong Kong’s status as a global financial hub makes it attractive for legitimate businesses, but its corporate structures also create opportunities for illicit activities. Understanding shell companies and nominee arrangements is critical for international partners conducting due diligence in this complex jurisdiction.

The Allure and Risk of Hong Kong Entities

Hong Kong’s simple incorporation process, tax advantages, and robust legal system draw legitimate enterprises. However, these same features facilitate shell company creation – entities with no significant assets or operations, often used to obscure ownership. According to the Financial Action Task Force (FATF), Hong Kong’s “limited disclosure regime” poses medium-high risks for money laundering, primarily due to nominee misuse and complex ownership chains.

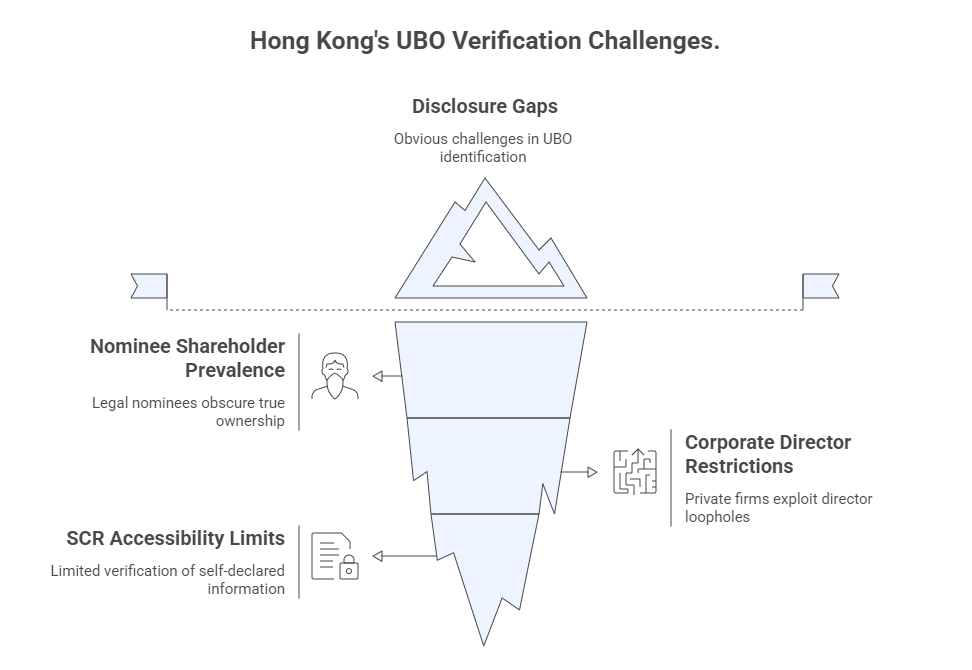

UBO Verification: Navigating Hong Kong’s Disclosure Gaps

Identifying Ultimate Beneficial Owners (UBOs) in Hong Kong faces three core challenges:

- Nominee Shareholder Prevalence: While nominee shareholders are legal, they mask true ownership. Hong Kong law requires companies to maintain a Register of Significant Controllers (SCR), but this is not publicly accessible. Only law enforcement, tax authorities, and financial institutions under AML checks can request access.

- Corporate Director Restrictions (Section 456 Loophole): Hong Kong’s Companies Ordinance (Cap. 622) prohibits corporate directors for public companies and companies limited by guarantee (S456). However, private companies not part of a listed group can still appoint corporate directors. This creates a significant loophole, allowing opaque entities (often registered offshore) to act as directors, further distancing UBOs from scrutiny.

- SCR Accessibility Limits: Even if an entity accesses the SCR (e.g., via a bank’s AML process), the information relies on self-declaration by the company. Verification mechanisms are limited, and penalties for false declarations, while substantial (fines up to HK$300,000 and imprisonment), require detection first.

Nominee Director Risks: Beyond Obscurity

Using nominee directors – individuals who lend their name but exercise no real control – introduces specific compliance and operational dangers:

- AML/CFT Compliance Failures: Financial institutions and regulated entities face severe penalties if their due diligence fails to pierce the nominee veil. The Hong Kong Monetary Authority (HKMA) actively fines institutions for inadequate UBO checks involving nominees.

- Lack of Oversight & Fraud: Nominee directors, by definition, are not managing the company. This creates opportunities for the hidden UBOs to engage in fraud, illicit transfers, or sanction evasion without the nominal director’s knowledge or consent.

- Reputational Damage: Discovering that a business partner relies on nominee structures can damage trust and brand reputation, implying association with secrecy or potential illegality.

- Legal Liability for Nominees: While acting nominally, the appointed director can still bear legal responsibility for company actions if they fail in their statutory duties (e.g., signing false documents, ignoring clear evidence of fraud).

5-Point Strategy for Effective UBO Tracing in Hong Kong

Overcoming these challenges requires a multi-layered approach:

- Scrutinize Incorporation Documents & Declarations: Obtain the Certificate of Incorporation, Business Registration Certificate, and the first Incorporation Form (NNC1 or NNC1G). Analyze the declared directors and shareholders. Look for red flags like corporate shareholders in private companies (exploiting the S456 loophole) or addresses linked to mass registration services. Accessing these foundational documents is a crucial first step.

- Demand and Analyze the Register of Significant Controllers (SCR): While not public, legitimate counterparties or their agents (like professional investigators or banks) can request the company provide access to its SCR under a valid AML/CFT justification. Cross-reference the declared significant controllers with other information.

- Conduct In-Depth Corporate Network Analysis: Use commercial registry searches (e.g., via the Hong Kong Companies Registry’s electronic search service) to map subsidiaries, sister companies, and holding structures. Look for circular ownership, links to high-risk jurisdictions, or connections to sanctioned entities. Tools like ChinaBizInsight’s Professional Enterprise Credit Report integrate complex corporate mapping for clearer visibility.

- Leverage Public Records & Litigation Checks: Search for the company, its directors (nominee or otherwise), and potential UBOs in Hong Kong court databases (Judiciary website), land registries (Land Registry’s Integrated Registration Information System – IRIS), and media archives. Litigation, property holdings, or negative news can reveal hidden connections or risks.

- Employ Enhanced Due Diligence (EDD) & Human Intelligence: For high-risk relationships, go beyond paperwork. Engage professional investigators for on-ground verification of business operations, interviews with industry contacts, and discreet inquiries to confirm the legitimacy of operations and the true source of control and funds. This is often where nominee arrangements unravel.

Essential Sanctions & PEP Screening Tools

Automated screening is vital but must be part of a broader strategy:

- World-Check One (Refinitiv): Industry-standard database covering sanctions, PEPs, heightened risk individuals, and adverse media globally, including deep coverage of Greater China.

- Dow Jones Risk & Compliance: Provides comprehensive sanctions, PEP, and adverse media data with robust search capabilities and ongoing monitoring alerts.

- LexisNexis® WorldCompliance™: Offers extensive global data on sanctions, PEPs, and negative news.

- Local HKMA & SFC Lists: Always check the Hong Kong Monetary Authority’s sanctions list and the Securities and Futures Commission’s list of sanctioned individuals/entities.

- China-Specific Databases: Utilize tools with strong coverage of mainland China and Hong Kong PEPs and sanctions (e.g., integrated features within comprehensive due diligence reports).

Mitigating Risks in the Hong Kong Landscape

Successfully navigating Hong Kong’s shell company and nominee risks requires acknowledging the jurisdiction’s specific regulatory gaps (like the S456 private company loophole) and the limitations of public UBO registers. Relying solely on basic registry checks is insufficient. A proactive, multi-source approach combining document analysis, corporate mapping, advanced screening tools, and, where necessary, human intelligence is paramount for compliance officers, investors, and businesses seeking secure partnerships in Hong Kong. Understanding the why behind nominee use – whether legitimate convenience or deliberate obscurity – is equally crucial for accurate risk assessment. For high-stakes engagements in complex structures, partnering with specialized due diligence providers offers access to deeper insights and verification capabilities beyond standard checks.

ChinaBizInsight

Your strategic bridge to transparent business in China.