For global businesses engaging with Hong Kong companies, audited financial statements are a cornerstone of trust. The auditor’s report attached to these statements offers more than just compliance; it provides a vital health check on a company’s financial credibility. Under Hong Kong’s robust regulatory framework, primarily the Companies Ordinance (Cap. 622), auditors play a critical gatekeeper role. Understanding how to interpret their reports – especially potential red flags – is essential for effective risk management and informed decision-making.

The Bedrock: Legal Requirements for HK Auditor Reports

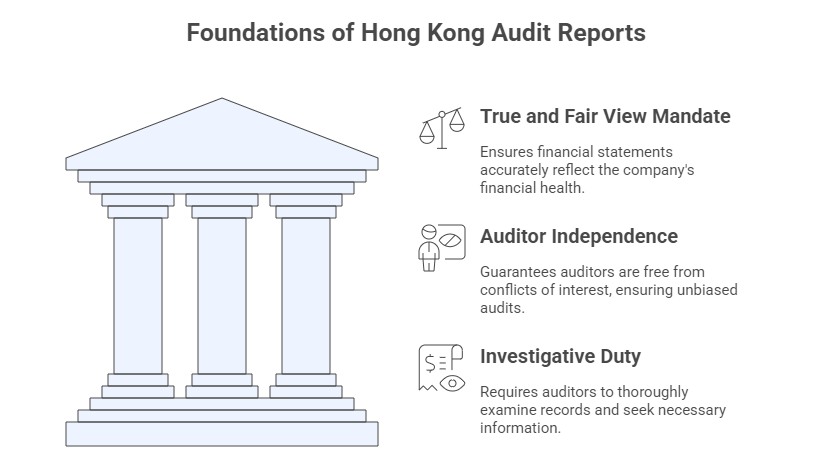

Hong Kong’s financial reporting ecosystem is designed for transparency and accountability. Key sections of the Companies Ordinance define what constitutes a reliable audit:

- The “True and Fair View” Mandate (Sections 380-383): This is the cornerstone. Auditors must explicitly state whether the financial statements give a “true and fair view” of:

- The company’s financial position at the year-end.

- Its financial performance for the year.

- (For group accounts) The financial position and performance of the company and its subsidiaries as a whole.

Failure to provide this opinion, or a qualification of it, is a major red flag. Sections 380 and 381 detail the specific requirements, including what must be included in the statements and notes (like directors’ emoluments and transactions – Section 383).

- Auditor Independence and Appointment (Sections 393-403): Credibility starts with independence. Section 393 strictly disqualifies individuals or firms with conflicts of interest (e.g., officers/employees of the company, their partners/employees, or those connected to parent/subsidiary undertakings) from being appointed auditors. Sections 395-403 govern the rigorous process for appointing and reappointing auditors (including resolutions at AGMs, filling casual vacancies, Court appointments, and deemed reappointment under specific conditions). Any irregularity or lack of clarity in the auditor’s appointment process should raise questions.

- Auditor’s Investigative Duty (Section 407): Auditors aren’t passive recipients of information. Section 407 mandates they conduct investigations sufficient to form opinions on:

- Adequacy of Accounting Records: Whether the company kept proper books (as required by Sections 373-377).

- Agreement with Records: Whether the financial statements match the underlying accounting records.

- Access to Information: Whether they obtained all necessary information and explanations.

If they fail to get adequate information (Section 407(3)) or find the records inadequate or the statements materially misaligned (Section 407(2)), they must state this in their report – a clear warning siren.

Decoding the Auditor’s Opinion: From Clean to Catastrophic

The heart of the auditor’s report is their opinion. The specific wording matters immensely:

- Unmodified (Clean) Opinion: The gold standard. The auditor concludes the financial statements give a true and fair view in accordance with the Companies Ordinance and HK Financial Reporting Standards. No significant issues identified.

- Wording includes: “In our opinion, the financial statements give a true and fair view…”

- Qualified Opinion (“Except For”): The auditor believes the financial statements are fairly presented except for a specific matter that is material but not pervasive (i.e., it doesn’t undermine the whole statement). The qualification clearly states the reason.

- Red Flag: Indicates a localized but significant problem, such as:

- Inability to obtain sufficient evidence for a specific transaction or balance (e.g., valuation of a unique asset, existence of overseas inventory).

- A departure from accounting standards that is material but confined.

- Wording includes: “In our opinion, except for the possible effects of the matter described in the Basis for Qualified Opinion section… the financial statements give a true and fair view…”

- Red Flag: Indicates a localized but significant problem, such as:

- Adverse Opinion: The most severe red flag. The auditor concludes that misstatements, individually or collectively, are both material and pervasive – meaning they fundamentally distort the financial statements. The statements do not give a true and fair view.

- Red Flag: Indicates profound, widespread issues casting doubt on the company’s reported financial health. Survival may be questionable.

- Wording includes: “In our opinion… the financial statements do not give a true and fair view…”

- Disclaimer of Opinion: The auditor is unable to form an opinion. This usually arises because they couldn’t obtain sufficient appropriate audit evidence on multiple, pervasive fronts.

- Red Flag: Often signifies catastrophic record-keeping, potential fraud, extreme uncertainty (like impending bankruptcy), or severe restrictions placed on the auditor by management. The reliability of the statements is completely unknown.

- Wording includes: “We do not express an opinion on the financial statements…”

Emphasis of Matter (EOM) Paragraphs: Sometimes, an auditor will add an EOM paragraph after an unmodified or qualified opinion. This highlights a fundamental uncertainty or a significant event (like a major lawsuit or post-balance sheet event) that’s appropriately disclosed in the financial statements. While not a qualification itself, an EOM flags something critical requiring the reader’s close attention.

Key Red Flags Lurking in Auditor Reports

Beyond the opinion type, scrutinize these specific elements:

- Going Concern Warnings: If the auditor expresses “material uncertainty” about the company’s ability to continue as a going concern (i.e., operate for the next 12 months), this is a critical red flag indicating severe financial distress. Check the notes for management’s plans and assess their feasibility.

- Scope Limitations (Section 407(3)): Explicit statements that the auditor couldn’t obtain necessary information or explanations are major warnings. Why was access denied or information unavailable? This often hints at obfuscation or underlying problems.

- Inadequate Accounting Records (Section 407(2)(a)): An auditor stating records were inadequate fundamentally undermines the reliability of the entire financial statement. This is a severe governance failure.

- Material Misstatements & Non-Compliance: Any mention of uncorrected material misstatements found during the audit, or non-compliance with the Companies Ordinance or accounting standards, is a direct red flag.

- Related Party Transactions (Section 383): While disclosures are required, excessive, complex, or inadequately explained transactions with related parties (directors, significant shareholders, their families/entities) can signal conflicts of interest, asset stripping, or profit manipulation. Check if the auditor highlights concerns about these.

- Frequent Auditor Changes: If a company changes its auditor frequently, especially if preceded by disagreements or qualifications, investigate why. It could indicate management shopping for a compliant auditor or unresolved disputes.

- Late Filing: While not in the report, consistently late filing of financial statements with the Companies Registry suggests poor financial controls or potential underlying problems management is hesitant to reveal.

Consequences of Falsehoods: The Regulatory Hammer

Hong Kong enforces audit integrity with significant penalties under the Companies Ordinance:

- False/Misleading Statements to Auditors (Section 413(3)): Knowingly or recklessly making false/misleading statements to an auditor is an offence punishable by substantial fines (up to HK$150,000 on indictment) and imprisonment (up to 2 years).

- Failure to Provide Information (Section 413(1)): Failing to provide information required by an auditor is an offence, with fines and potential daily penalties for continuing offences.

- Auditor’s Duty & Liability: Auditors face severe penalties (fines up to HK$300,000 and imprisonment up to 12 months – Sections 373, 374, 379, etc.) for failing in their duties (e.g., not keeping proper records, not preparing reports correctly, not reporting discovered issues). Provisions attempting to exempt auditors from liability for negligence or breach of duty are void (Section 415).

- Company Liability: Companies and their responsible persons face significant fines (often at Level 4 or 5, meaning tens of thousands of dollars, or specific higher amounts like HK$300,000) and potential imprisonment for contraventions related to accounting records, financial statement preparation, director reports, and failing to send required documents to members or the Registrar.

Glossary of Key Auditor Report Terms

- Adverse Opinion: Auditor’s conclusion that financial statements are materially misstated and do not give a true/fair view.

- Emphasis of Matter (EOM): Paragraph highlighting a properly disclosed, fundamental uncertainty or significant event relevant to understanding the financials.

- Going Concern: Assumption the company will continue operating for the foreseeable future (at least 12 months).

- Material Misstatement: An error or omission in the financial statements significant enough to influence users’ decisions.

- Modified Opinion: An umbrella term covering Qualified, Adverse, or Disclaimer opinions.

- Pervasive: Describes misstatements or their effects that are widespread throughout the financial statements.

- Qualified Opinion (“Except For”): Auditor’s conclusion that, except for a specific material matter, the financial statements give a true/fair view.

- Disclaimer of Opinion: Auditor’s declaration that they cannot form an opinion on the financial statements.

- True and Fair View: The fundamental requirement that financial statements accurately and completely reflect the company’s financial position and performance.

- Unmodified Opinion (Clean Opinion): Auditor’s conclusion that financial statements give a true/fair view without reservations.

Protecting Your Interests: Beyond the Report

While dissecting the auditor’s report is crucial, it’s often just the first step. A clean opinion doesn’t guarantee perfection, and even qualified opinions require deeper investigation into the specifics. For international partners and investors, conducting independent financial due diligence is paramount, especially when:

- Entering significant contracts or joint ventures.

- Considering mergers or acquisitions.

- Extending substantial credit.

- Observing any of the red flags mentioned above.

This due diligence involves verifying financial data, assessing the quality of underlying assets and earnings, scrutinizing cash flows, evaluating management forecasts, and understanding the context behind auditor findings. It provides the nuanced understanding needed to mitigate risks inherent in cross-border business relationships in Hong Kong. Partnering with experts experienced in navigating Hong Kong’s corporate landscape and regulatory requirements can be invaluable in this process. For comprehensive insights into a Hong Kong company’s financial standing and governance, consider exploring specialized due diligence services.

By mastering the language of Hong Kong auditor reports and the legal framework underpinning them, you transform complex financial disclosures into powerful tools for risk assessment and strategic decision-making. Vigilance in spotting red flags is not just prudent; it’s essential for safeguarding your interests in one of the world’s most dynamic business hubs.

ChinaBizInsight

Your strategic bridge to transparent business in China.