Imagine this: You’ve found the perfect Hong Kong target company. Due diligence checks out, financing is secured, and the acquisition agreement is drafted. Then, weeks before closing, your legal team drops a bombshell: The deal structure violates Hong Kong’s financial assistance rules, potentially voiding the transaction and exposing directors to criminal liability. Suddenly, your “sure thing” acquisition hangs in the balance.

This isn’t a hypothetical nightmare. It’s a frequent and often devastating reality for unprepared buyers navigating Hong Kong’s strict prohibitions on financial assistance under Sections 274-289 of the Companies Ordinance (Cap. 622). Understanding these rules isn’t just legal compliance; it’s fundamental to executing a successful, secure acquisition in Hong Kong.

What is Financial Assistance? (And Why is it Mostly Illegal?)

At its core, “financial assistance” refers to a company using its own funds or assets to help someone acquire its shares. Section 275 of the Companies Ordinance imposes a general prohibition against a Hong Kong company (or its subsidiary) giving financial assistance:

- Directly or indirectly, for the purpose of an acquisition of its own shares (or shares in its holding company); or

- To reduce or discharge any liability incurred in such an acquisition.

Common Examples of Prohibited Financial Assistance:

- The Target Pays the Buyer: The target company lending money to the buyer to fund the purchase of its own shares.

- Asset Backstop: The target company gifting or selling crucial assets to the buyer at a significant undervalue, effectively subsidizing the purchase price.

- Guaranteeing the Buyer’s Loan: The target company providing a guarantee or security for a loan taken out by the buyer specifically to acquire the target’s shares.

- Post-Acquisition Cleanup: The target company using its cash reserves to repay the loan the buyer took out to acquire it.

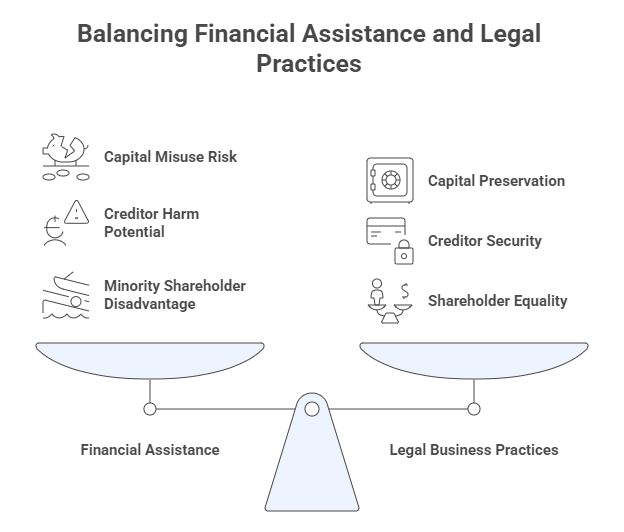

Why is this Illegal? The rationale is rooted in capital maintenance and creditor protection. A company’s capital (shareholders’ equity and assets) should be used for its legitimate business purposes, not siphoned off to facilitate a change in its ownership. Doing so unfairly prejudices creditors by potentially leaving the company insolvent or undercapitalized after the acquisition. It can also disadvantage minority shareholders.

The High Stakes: Consequences of Breach

Ignoring Section 275 isn’t an option. The consequences are severe:

- Criminal Liability: Officers of the company (directors, shadow directors) who “authorize or permit” the illegal financial assistance commit an offence. Conviction can lead to substantial fines and imprisonment (fines up to HK$150,000 and imprisonment for up to 2 years for a summary conviction; significantly higher penalties on indictment).

- Civil Consequences: While Section 276 clarifies that the validity of the financial assistance itself (e.g., a loan or guarantee) isn’t automatically voided by the breach, the transaction it facilitated (the share acquisition) can be challenged. More critically:

- Directors breach their fiduciary duties (duty to act in the company’s best interests, duty to exercise care, skill, and diligence).

- Affected parties (creditors, minority shareholders, liquidators) may sue directors for compensation for losses suffered.

- The transaction structure becomes legally vulnerable.

- Deal Derailment: Discovering a breach late can force expensive restructuring, delay closing, or even cause the entire deal to collapse. Reputational damage is significant.

Is There Any Way Around It? Understanding the Exceptions

Recognizing the need for legitimate corporate activity, the Ordinance provides specific exceptions where financial assistance is permitted. Navigating these requires careful legal analysis:

- Principal Purpose Exception (Section 278): Assistance is permitted if giving it is NOT the principal purpose of the transaction, AND the assistance is given in good faith in the interests of the company. This is narrow and fact-specific. Proving the “principal purpose” wasn’t the acquisition is difficult if assistance is a core part of the funding.

- Ordinary Course of Business (Section 511): Assistance given by a company whose ordinary business includes lending money (like a bank), provided the assistance is given in the ordinary course of that business and on standard commercial terms. This doesn’t apply to non-financial institutions.

- Loans to Employees (Section 281): Permits loans to bona fide employees (other than directors) to enable them to acquire shares in the company or its holding company for their beneficial ownership. Strict limits apply.

- De Minimis Exception (Section 283): Crucially, private companies (not listed) can provide financial assistance if the total value of the assistance, plus any other assistance given and not repaid, does not exceed 5% of the company’s shareholders’ funds. Shareholders’ funds are calculated from the latest audited financial statements. This is often the most practical route for smaller acquisitions involving private companies.

- Shareholder Approval – The “Whitewash” Procedure (Sections 284-289): This is the most common pathway for significant acquisitions, especially involving public companies or exceeding the 5% threshold. It involves:

- Directors’ Solvency Statement: Directors must make a statutory declaration (a “solvency statement”) confirming that:

- Immediately after giving the assistance, the company will be able to pay its debts as they fall due (liquidity test); AND

- The company will be able to pay its debts as they fall due during the 12 months following the assistance (or until it is wound up, if sooner) (solvency test). Directors face criminal liability for making this statement without reasonable grounds.

- Shareholder Approval: The financial assistance must be approved by an ordinary resolution (over 50% vote) of the shareholders excluding the shares being acquired and those held by the person receiving the assistance (or their associates). This ensures disinterested approval.

- Court Approval (Optional but Common): While not always mandatory, parties often apply to the Court for approval before the assistance is given. The Court reviews the solvency statement, the fairness of the proposal, and whether creditors/minority shareholders are prejudiced. Obtaining court sanction significantly de-risks the transaction and provides legal comfort.

- Directors’ Solvency Statement: Directors must make a statutory declaration (a “solvency statement”) confirming that:

The Essential “Before & After” Checklist for M&A Due Diligence

BEFORE Structuring the Deal:

- Identify the Risk: Scrutinize every proposed flow of funds or assets. Ask: “Is the target company (or its HK subsidiary) directly or indirectly providing value that helps fund the purchase of its own shares?” If yes, STOP.

- Quantify Potential Assistance: If assistance seems necessary, calculate its value precisely. Compare it against the target’s latest audited shareholders’ funds to assess if the 5% de minimis exception might apply.

- Engage HK Legal Counsel Early: This is non-negotiable. Specialist HK corporate lawyers are essential to:

- Confirm if the proposed structure breaches S275.

- Advise on available exceptions (especially whitewash feasibility).

- Draft the solvency statement and shareholder resolutions.

- Guide the court application process if needed.

- Assess Target Solvency: The whitewash procedure hinges on directors making a credible solvency statement. Thorough financial due diligence is critical to support this. Consider an independent solvency review if significant assistance is involved.

- Plan the Whitewash Timeline: The shareholder approval and potential court process add significant time (weeks or months). Factor this into your deal timetable immediately.

AFTER Identifying a Potential Breach:

- Immediate Legal Review: Halt any further steps reliant on the suspect assistance. Get definitive legal advice on the nature and severity of the breach.

- Explore Remediation: Can the structure be altered to remove the offending assistance? Can a compliant whitewash procedure be implemented retroactively? (This is complex and risky).

- Assess Director Liability: Directors involved may need independent legal advice regarding their potential exposure.

- Disclose to Stakeholders: Depending on the severity, disclosure to regulators (SFC), creditors, or minority shareholders might be necessary.

- Document Diligence: Meticulously document all steps taken to identify, assess, and remediate the issue to demonstrate good faith if challenged later.

Why Robust Due Diligence is Your Best Defense

The complexities of Hong Kong’s financial assistance rules underscore why comprehensive, pre-acquisition due diligence is paramount. Surface-level checks won’t suffice. You need deep visibility into:

- Target Company Structure: Identify all relevant HK entities.

- Proposed Transaction Mechanics: Pinpoint any funding flows involving the target.

- Target Financial Health: Essential for assessing solvency for any whitewash.

- Legal Compliance History: Past breaches could signal governance issues.

Specialized due diligence services go beyond standard financial audits. They actively screen transaction structures for Section 275 compliance and assess the feasibility and risks of necessary whitewash procedures. This proactive approach is far cheaper and less stressful than dealing with a breach discovered at the eleventh hour.

Conclusion: Navigate Legally, Secure Your Deal

Hong Kong’s prohibition on financial assistance is a formidable legal hurdle in M&A. Breaching Section 275 isn’t a minor oversight; it carries serious criminal and civil penalties that can derail deals and damage reputations. Successfully navigating this landscape requires:

- Awareness: Understanding what constitutes illegal financial assistance.

- Early Legal Engagement: Involving specialist HK corporate lawyers from the deal’s inception.

- Strategic Use of Exceptions: Leveraging the de minimis rule or meticulously planning and executing the whitewash procedure.

- Uncompromising Due Diligence: Conducting thorough investigations into the target and the proposed transaction structure to identify and mitigate this risk proactively.

By prioritizing compliance with Sections 274-289, acquirers can structure their Hong Kong acquisitions securely, avoid costly pitfalls, and ensure a smooth path to closing. Don’t let hidden legal traps turn your acquisition dream into a liability nightmare. Understand the rules, plan meticulously, and seek expert guidance. Your deal’s success depends on it.

ChinaBizInsight

Your strategic bridge to transparent business in China.