Expanding your business into Hong Kong offers unparalleled access to Asian markets and a globally respected legal framework. However, for foreign entities (“non-Hong Kong companies”), navigating Part 16 of the Hong Kong Companies Ordinance (Cap. 622) is critical for legal compliance. Misunderstanding these requirements can lead to severe penalties, operational disruptions, and reputational damage. This guide clarifies the registration process, ongoing obligations, and strategic considerations for foreign businesses.

What Qualifies as a Non-Hong Kong Company?

A “non-Hong Kong company” is any entity incorporated outside Hong Kong that:

- Establishes a “place of business” in Hong Kong after March 1, 2014 (Part 16 commencement date), OR

- Maintains a pre-existing place of business in Hong Kong post-commencement.

Crucial Definition: “Place of Business”

This includes:

- Physical offices (even shared spaces)

- Sales outlets or warehouses

- Hiring local staff under employment contracts

- Bank accounts used for operational transactions (not merely holding funds)

Example: A Singapore-based e-commerce company storing inventory in a Hong Kong warehouse must register.

Branch vs. Subsidiary: Critical Distinctions

Branch Office

- Not a separate legal entity; liabilities flow to the parent company.

- Requires registration under Part 16.

- Mandatory to disclose overseas financials publicly.

Hong Kong Subsidiary

- A separate legal entity incorporated locally.

- Governed by standard Hong Kong company law (limited liability).

- Financials remain private unless audited.

💡 Strategic Insight: 75% of foreign businesses choose subsidiaries for liability protection and tax flexibility (HK Inland Revenue Dept, 2023).

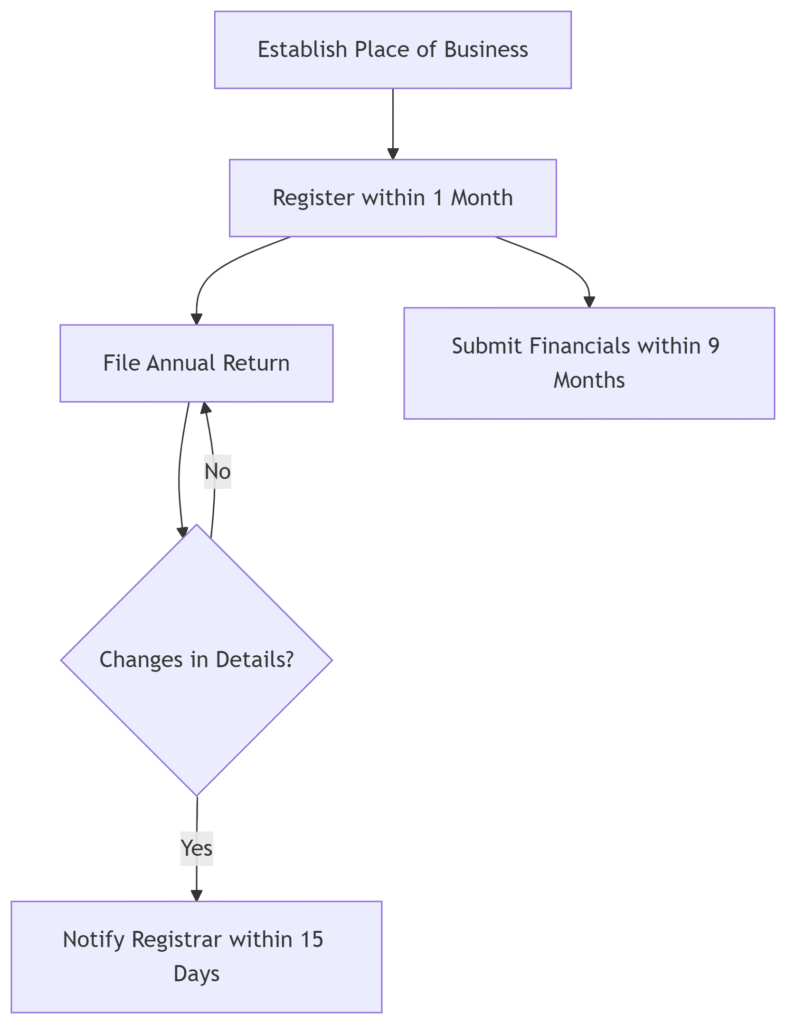

Part 16 Registration: Step-by-Step Process

1. Application Timeline

You must register with the Companies Registry within 1 month of establishing a Hong Kong place of business. Late filings incur penalties (see below).

2. Required Documents

- Certified copy of Certificate of Incorporation (with certified English/Chinese translation)

- Constitutional documents (e.g., Articles of Association)

- List of Hong Kong-authorized representatives (must be local individuals or firms)

- Details of directors and company secretary (if applicable)

3. Name Registration Rules

- If your company name differs from its original name (e.g., due to language), register a bilingual “approved name”.

- The Registrar may issue a Regulation Notice if your name:

- Conflicts with existing entities (“ABC Limited” vs. “ABC Ltd”)

- Is misleading (“Bank of Europe HK” without banking license)

- Contains sensitive terms (“Government”, “Trust”)

Ongoing Compliance Requirements

Annual Obligations

- Annual Return: Filed within 42 days of the anniversary of registration.

- Financial Statements: Submit audited accounts within 9 months of financial year-end. Exemptions exist for small private groups meeting 2 of 3 criteria:

- ≤ HK$100 million turnover

- ≤ HK$100 million total assets

- ≤ 100 employees

Changes Requiring Notification

Notify the Registrar within 15 days of:

- Alterations to company name or constitutional documents.

- Changes in directors/authorized representatives.

- Cessation of Hong Kong business operations.

Penalties for Non-Compliance

| Violation | Maximum Penalty |

|---|---|

| Failure to register | HK$50,000 + HK$1,000/day (ongoing) |

| Late annual return filing | HK$10,320 + prosecution |

| Misleading company name | HK$100,000 + compulsory name change |

Case Study (2022): A U.S. tech firm incurred HK$87,000 in penalties for 11 months of unregistered operations.

Compliance Flowchart: Key Deadlines

Why Due Diligence Matters for Partners

Foreign companies often engage local suppliers, distributors, or law firms. Verify their legitimacy by requesting:

- Business Registration Certificate (BRC)

- Certified Excerpt of the Companies Register

- Directors’ Report (for public companies)

For thorough verification, consider a Hong Kong Company Credit Report, which includes legal status, shareholder details, and financial risk indicators.

Document Legalization: Connecting Hong Kong and Global Operations

Contracts, certificates, or reports issued in Hong Kong often require apostille certification (for Hague Convention members) or consular legalization (for non-members) for overseas use. Key steps include:

- Notarization by a Hong Kong solicitor

- Certification by the High Court

- Apostille from the HK SAR Authentication Office

⏱️ Tip: Legalization takes 5–7 working days. Expedited services are available through specialists.

Conclusion: Building Confidence in Your Hong Kong Operations

Registering under Part 16 isn’t just a legal formality—it’s foundational to credible operations in Hong Kong. By understanding branch/subsidiary distinctions, naming rules, and filing deadlines, foreign companies mitigate risks while leveraging Hong Kong’s strategic advantages.

Proactive Step: Bookmark the Hong Kong Companies Registry for official forms and fee updates. For complex structures, consult a Hong Kong corporate service provider to ensure seamless compliance.

ChinaBizInsight

Your strategic bridge to transparent business in China.