When a Hong Kong company is struck off the Companies Register, many assume its legal existence—and associated risks—vanish forever. Yet under Division 4 of Part 15 of the Hong Kong Companies Ordinance (Cap. 622), dissolved entities can be resurrected through administrative or court-led restoration. This process, particularly under Section 760, creates a legal twilight zone where historic transactions suddenly reactivate dormant liabilities. For businesses inheriting assets or contracts linked to dissolved entities, this poses severe commercial threats.

How Restoration Works: Two Pathways

Hong Kong law provides distinct restoration mechanisms:

- Administrative Restoration (Section 760)

- Applicable if:

- The company was dissolved within 6 years

- Dissolved due to Registrar’s “mistake” (e.g., erroneous strike-off)

- Was operational at dissolution

- Requires former directors/members to file with the Companies Registry

- Effect: Legal personality retroactively reinstated

- Court-Ordered Restoration (Section 765)

- Used for:

- Asset recovery (e.g., property, IP, debts)

- Pursuing insurance claims or legal actions

- Restoring credit history records

- Available beyond 6-year window

- Critical consequence: All pre-dissolution liabilities revive instantly

The Liability Time Bomb: Case Law Exposures

When restoration occurs, courts treat the company as never dissolved. Historic obligations resurface with full force:

Case Study 1: Contractual Claims (Re Yick Fung Ltd [2016] HKCFI 195)

- A supplier sued a restored company for unpaid 2012 invoices.

- Court held: Restoration validated claims dating back 8 years. Defendant liable for principal + compounding interest.

Case Study 2: Property Disputes (Re Golden Hill Ventures [2020] HKCFI 842)

- Company dissolved in 2015 with undisclosed property leases.

- After 2020 restoration, landlords demanded back-rent + penalties totaling HK$3.2M.

Case Study 3: Director Liability (Re Insight Marketing Ltd [2018] HKCFI 1123)

- Restored company’s directors faced D&O claims for pre-dissolution compliance failures.

- Courts permitted personal injury lawsuits against revived entities.

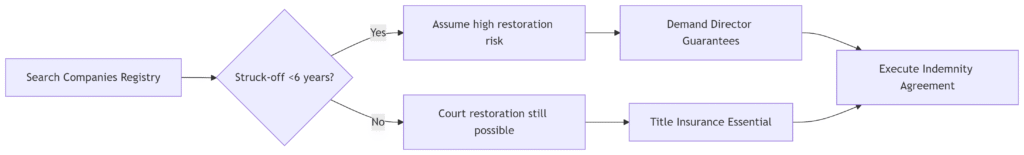

4 Protective Strategies for Transaction Counterparties

Businesses handling assets/contracts tied to dissolved HK entities must:

- Conduct Deep-Due Diligence

- Verify dissolution date via Companies Registry Direct Search

- Scour Gazette strike-off notices (mandatory publication under Section 746)

- Obtain statutory declarations from former directors confirming no pending claims

- Demand Indemnity Clauses

Sample contractual safeguard:

“The Warrantors jointly guarantee that no application for restoration of [Dissolved Company] shall be made under Sections 760-773 of the Companies Ordinance. Breach triggers immediate compensation for all resultant losses.”

- Secure Director Guarantees

- Require personal undertakings from ex-directors to cover revival risks

- Validate their financial capacity using Executive Risk Reports

- Title Insurance for Asset Transfers

- Insure against restoration-triggered claims on acquired property/IP

- Standard exclusion: Liabilities known pre-acquisition

Why Speed Matters: The 6-Year Window

Administrative restoration expires after 6 years (Section 766). Beyond this:

- Claimants must pursue costly court restoration

- Evidence degradation weakens cases

- But note: Court applications have no statutory time limit

Mitigation Through Expert Verification

Before transacting with dissolved-company assets:

Pro Tip: Always verify directors’ post-dissolution conduct. Undisclosed bankruptcy or litigation history exponentially increases liability exposure. Our Executive Risk Reports uncover hidden red flags across Greater China.

Conclusion: Treat Dissolution as a Pause, Not an End

Hong Kong’s restoration mechanisms serve legitimate purposes—recovering stranded assets, fulfilling creditor claims, or rectifying registry errors. Yet for unwary businesses, they create perilous retroactive liability.

Due diligence lesson: A company’s dissolution is merely a legal comma. Until the 6-year administrative window closes (and even after, via courts), presume it could resurrect. Structure transactions accordingly—or risk inheriting a decade’s worth of revived obligations.

Key Takeaway: Restoration under Section 760 isn’t mere compliance paperwork. It’s a legal resurrection with teeth. Protect transactions with indemnities, guarantees, and forensic verification of dissolved entities’ histories.

ChinaBizInsight

Your strategic bridge to transparent business in China.