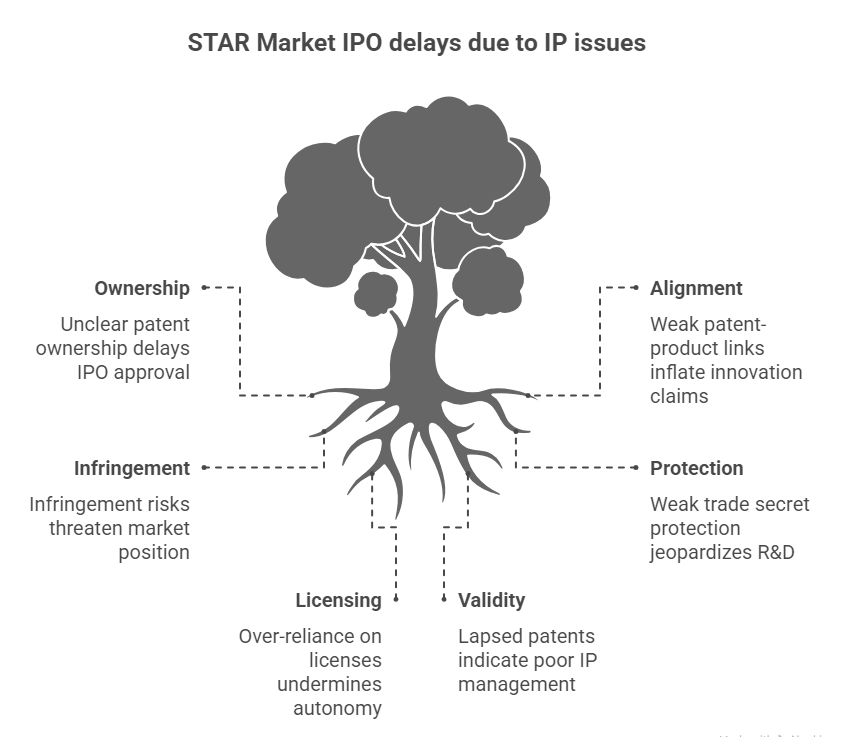

Securing approval for a Science and Technology Innovation Board (STAR Market) IPO in China demands rigorous intellectual property (IP) due diligence. Regulators scrutinize IP portfolios to assess innovation authenticity, legal risks, and commercialization viability. Understanding recurring IP inquiry themes helps companies prepare robust disclosures and avoid delays.

1. Core Patent Ownership & Inventorship Verification

Why It’s Critical: Ownership disputes or improper inventor attribution can derail IPOs. Regulators demand clear proof that patents are validly assigned to the issuer.

Common Queries:

- Evidence linking inventors to R&D employment records

- Assignment agreements for patents developed pre-incorporation

- Analysis of patent transfers from universities/research partners

Case Example: A semiconductor firm delayed its IPO after failing to prove it owned patents originally filed by a founder’s previous employer.

2. Patent-to-Core Technology Alignment

Why It’s Critical: Patents must directly underpin revenue-generating products or services. Misalignment implies inflated innovation claims.

Regulator Focus:

- Mapping patents to primary products/technical solutions

- Assessing contribution of patents to revenue (>50% is ideal)

- Disclosure of patents not integrated into core business

Data Insight: 33% of 2023 STAR Market IPO rejections cited weak patent-product linkages (Shanghai Stock Exchange).

3. Freedom-to-Operate (FTO) & Infringement Risks

Why It’s Critical: Undisclosed infringement exposure threatens market position and valuation.

Inquiry Patterns:

- Third-party patent landscape analysis for core technologies

- History of infringement litigation/disputes

- Mitigation strategies (e.g., licensing, design-arounds)

Red Flag: A biotech IPO stalled after competitors revealed blocking patents covering its drug delivery system.

4. Trade Secret Protection Mechanisms

Why It’s Critical: Weak safeguards jeopardize proprietary processes integral to R&D.

Key Disclosures:

- Employee confidentiality/non-compete agreements

- IT security protocols for technical data

- Physical access controls to labs/production sites

Regulatory Expectation: Documented, auditable protection systems meeting ISO 27001 standards.

5. IP Licensing & Dependency Risks

Why It’s Critical: Over-reliance on licensed IP undermines business autonomy.

Scrutiny Areas:

- Revenue impact of inbound licenses

- Restrictions in agreements (e.g., field-of-use, exclusivity)

- Contingency plans for license non-renewal

High-Risk Scenario: >30% of revenue tied to a single expiring license.

6. Patent Validity & Maintenance

Why It’s Critical: Lapsed patents or unpaid fees indicate poor IP management.

Verification Demands:

- Certificates of patent payment history

- Independent validity assessments for key patents

- Procedures ensuring timely annuity payments

Compliance Tip: Use official China National Intellectual Property Administration (CNIPA) records for verification.

Proactive Due Diligence: Mitigating IPO Roadblocks

STAR Market applicants should conduct an internal IP audit 12–18 months pre-filing:

- Ownership Cleanup: Rectify incomplete assignments; document inventor contributions.

- FTO Analysis: Identify blocking patents; pursue licenses or design modifications.

- Trade Secret Inventory: Classify protected know-how; audit protection measures.

- Portfolio Pruning: Abandon irrelevant patents to reduce maintenance costs.

- Third-Party Verification: Engage experts to validate IP-core business alignment.

For foreign investors assessing Chinese tech firms, independent IP verification is non-negotiable. Comprehensive patent, trademark, and trade secret audits reveal regulatory risks and innovation quality. Verify your Chinese partner’s IP claims with authoritative reports to avoid costly oversights.

ChinaBizInsight

Your strategic bridge to transparent business in China.