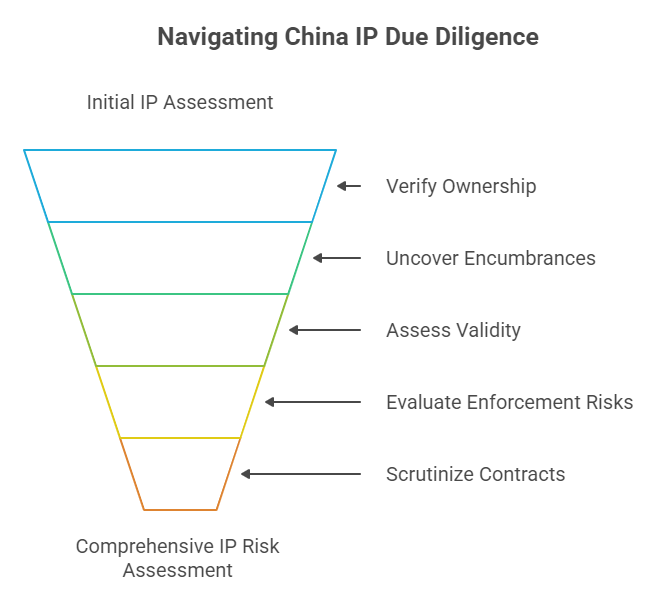

Cross-border mergers and acquisitions (M&A) targeting Chinese companies promise significant growth opportunities. However, beneath the surface often lie complex intellectual property (IP) risks that can derail deals, diminish value, or trigger costly litigation. Overlooking thorough IP due diligence in China is not an option; it’s a direct path to value destruction. China’s unique IP landscape, marked by nuances in enforcement, complex ownership structures, and evolving regulations, demands meticulous verification. Here’s your essential checklist to navigate these critical risks:

1. Verify Ownership & Chain of Title: The Foundation

- Official Registry Checks: Confirm ownership of patents, trademarks, copyrights, and domain names directly with the Chinese National Intellectual Property Administration (CNIPA) and the Ministry of Industry and Information Technology (MIIT) for domains. Do not rely solely on the target company’s representations or certificates.

- Assignment History Scrutiny: Trace the complete history of IP assignments. Ensure all transfers from inventors (for patents) or previous owners were executed correctly with valid, registered assignment agreements. Look for gaps or irregularities.

- Employee & Contractor Agreements: Meticulously review contracts with employees and contractors involved in creation. Confirm they explicitly assign all IP rights related to their work to the company. Vague clauses are a major red flag.

2. Uncover Hidden Encumbrances & Restrictions

- Pledges & Security Interests: Search CNIPA’s registry for any record of IP assets (especially patents and trademarks) being pledged as loan collateral. A pledged patent can be seized by creditors, devastating the asset’s value to the acquirer. This is a frequently overlooked critical risk.

- Exclusive Licenses: Identify any existing exclusive or sole licenses granted to third parties. These significantly restrict the acquirer’s ability to use or commercialize the IP. Review license terms for change-of-control clauses that could terminate the license upon acquisition.

- Government Funding Strings: Determine if IP development involved state funding (national or local). Such funding often comes with “rights to apply” clauses or usage restrictions benefiting the government, potentially limiting exclusivity or requiring approvals for overseas use or transfer.

- Co-ownership Issues: Identify any jointly owned IP. Understand the rights and obligations of each co-owner, as their consent is typically needed for licensing or enforcement actions. Unclear co-ownership is a major source of future conflict.

3. Assess Validity, Scope & Freedom to Operate (FTO)

- Patent Validity & Scope: For patents, scrutinize the prosecution history, claims breadth, and payment of maintenance fees. Assess the likelihood of surviving invalidation challenges (common in China). Conduct a thorough FTO analysis to ensure the target’s products/processes don’t infringe third-party patents in key markets (China and abroad).

- Trademark Validity & Conflicts: Verify trademarks are registered for the correct classes of goods/services actually used. Actively search for potentially conflicting prior trademarks (including unregistered well-known marks) that could lead to cancellation or infringement claims. Monitor trademark squatting risks.

- Trade Secret Protection: Evaluate the adequacy of the target’s trade secret protection measures (NDAs, confidentiality clauses, IT security, physical access controls, employee training). Weak protection greatly increases the risk of misappropriation and value loss.

4. Evaluate Enforcement Risks & Litigation Exposure

- Active & Potential Litigation: Conduct comprehensive searches in Chinese court databases for ongoing or recently concluded IP litigation (infringement suits, validity challenges). Review any past judgments or settlements. Assess the merits and potential liabilities of unresolved disputes.

- Enforcement Realities: Understand the practical challenges of enforcing IP rights in China, including local protectionism, variations in court expertise, and the time/cost involved. This impacts the real value of the IP portfolio.

- Administrative Actions: Check for any history of or ongoing administrative actions (e.g., raids by local market supervision bureaus, CNIPA investigations).

5. Scrutinize Key Contracts & Regulatory Compliance

- License Agreements (In & Out): Review all inbound (target using others’ IP) and outbound (others using target’s IP) licenses. Pay close attention to terms regarding scope, exclusivity, royalties, sub-licensing rights, termination clauses, and crucially, assignment/change-of-control provisions.

- R&D Collaboration Agreements: Examine contracts with universities, research institutes, or other companies. Clarify IP ownership, background IP, foreground IP, publication rights, and commercialization rights arising from collaborations.

- Technology Import/Export Compliance: Ensure compliance with Chinese regulations governing the import and export of restricted or sensitive technologies. This includes filings with MOFCOM and potential security reviews.

- Data Privacy & Security: Verify compliance with China’s Personal Information Protection Law (PIPL) and data security laws, especially if the IP involves data collection or processing. Non-compliance risks hefty fines and operational disruption. Ensure proper cross-border data transfer mechanisms are in place if relevant.

6. Special Considerations for NEEQ/OTC Companies & Enforcement Evidence

- Public Disclosures: If the target is listed on NEEQ (China’s OTC market), meticulously review its public disclosures for information related to IP ownership, litigation, licenses, and valuations. Inconsistencies with internal findings are a major red flag.

- Evidence Collection Rules: Critically, be aware of stringent rules under Article 13 of the State Council Regulations on Handling Foreign-Related Intellectual Property Disputes (2025). Evidence collected within China for foreign proceedings (like M&A due diligence potentially triggering overseas litigation) must comply strictly with Chinese law and international treaties. Unlawfully gathered evidence (e.g., unauthorized recordings, improperly obtained documents) is inadmissible in Chinese courts and can create liability. Engage professionals experienced in lawful evidence collection methods in China.

The High Cost of Incomplete Due Diligence

Underestimating China’s IP due diligence complexity has severe consequences:

- Massive Value Erosion: Discovering encumbered, invalid, or infringing IP post-acquisition drastically reduces ROI.

- Catastrophic Deal Failure: Undisclosed liabilities or fatal ownership flaws can collapse the transaction at the last moment.

- Costly Litigation: Infringement suits or ownership challenges drain resources and damage reputation.

- Operational Paralysis: Inability to use core IP due to licensing restrictions or validity issues halts business plans.

- Regulatory Penalties: Non-compliance with tech transfer or data laws results in fines and sanctions.

Mitigating the Risk: Expertise is Non-Negotiable

Navigating this intricate checklist demands specialized local knowledge and access to authoritative Chinese registries and data sources. Relying solely on internal teams or generic due diligence approaches is perilous.

Partnering with a specialized provider like ChinaBizInsight is crucial for uncovering hidden IP risks in Chinese targets. We provide comprehensive IP verification services, leveraging direct access to CNIPA records, litigation databases, and deep understanding of local regulations and enforcement nuances. Our due diligence reports deliver the clarity and confidence needed to secure your investment and avoid costly post-acquisition surprises.

Don’t let hidden IP landmines destroy your cross-border M&A ambitions in China. Rigorous, expert-led due diligence is your most valuable safeguard. Ensure your next deal is built on solid, verified intellectual property foundations.

ChinaBizInsight

Your strategic bridge to transparent business in China.