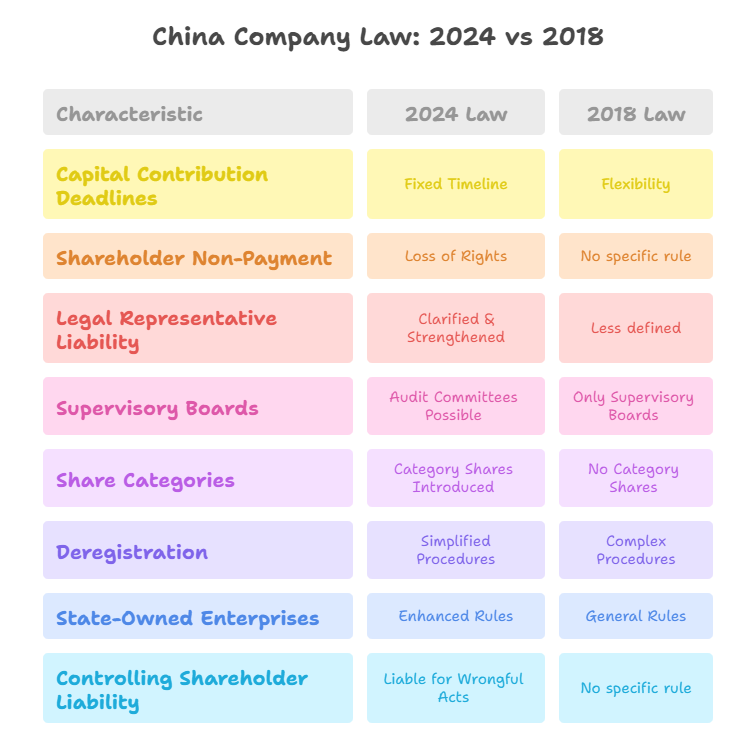

China’s revised Company Law, effective July 1, 2024, marks the most significant overhaul in corporate governance in years. For foreign businesses and investors navigating the Chinese market, understanding these changes is crucial for risk management, compliance, and strategic planning. This article dissects eight critical amendments in the 2024 Law compared to the 2018 version, highlighting their practical implications for your operations and due diligence processes.

1. Capital Contribution Deadlines: From Flexibility to Fixed Timeline (Art. 47)

- 2018 Law: No statutory deadline existed for shareholders to fully pay up their subscribed capital. Deadlines were set in the Articles of Association (AoA) or shareholder agreements, often very long-term.

- 2024 Law: Mandates that all subscribed capital must be fully paid within 5 years from the company’s establishment date (Art. 47). This period can be shorter if specified in the AoA. Exemptions apply if other laws/regulations (e.g., specific sectors) dictate different rules.

- Impact on Foreign Investors:

- Due Diligence Imperative: Scrutinizing a potential Chinese partner’s capital structure is now more urgent. Verify not just the registered capital, but the subscribed capital amount and the actual payment status within the 5-year window. A company with large subscribed capital but minimal paid-in capital could face liquidity issues or forced capital reduction soon.

- JV Negotiations: Foreign partners in JVs need clear agreements on capital call schedules aligned with the 5-year limit.

- Risk Indicator: Failure to meet capital deadlines triggers potential shareholder liability (see Point 2) and signals deeper financial or operational weaknesses. Verify capital status meticulously.

2. Shareholder “Loss of Rights” for Non-Payment (Art. 52)

- 2018 Law: Lacked a clear, efficient mechanism for dealing with shareholders who failed to pay their subscribed capital on time. Remedies were often cumbersome (lawsuits for specific performance or damages).

- 2024 Law: Introduces a formal “Loss of Rights” (失权 – shīquán) procedure (Art. 52). If a shareholder fails to pay after a formal written demand (with a grace period of at least 60 days), the company’s Board of Directors can resolve to issue a notice stripping the shareholder of their rights (and corresponding equity) related to the unpaid amount. This equity must then be transferred or cancelled.

- Impact on Foreign Investors:

- Enhanced Leverage for JVs/Partnerships: Provides a clearer contractual and legal path to address non-performing local partners failing their capital commitments.

- Due Diligence Red Flag: Discovering that a company has issued capital call notices or is undergoing loss-of-rights procedures against shareholders is a major red flag regarding financial stability and internal governance. Check shareholder contribution history and potential disputes.

- Stricter Enforcement: Signals regulators’ intent to ensure capital adequacy and shareholder commitment.

3. Clarified & Strengthened Legal Representative Liability (Art. 11)

- 2018 Law: Established the Legal Representative (法定代表 – fǎdìng dàibiǎo, usually the Chairperson, Exec Director, or GM) as acting on behalf of the company. Liability specifics, especially vis-à-vis third parties, were less explicitly defined.

- 2024 Law: Significantly clarifies and strengthens liability (Art. 11):

- The company bears civil liability for acts of the Legal Rep done in the company’s name.

- Restrictions on the Legal Rep’s authority (in AoA or Board resolutions) cannot be asserted against a bona fide third party.

- If the Legal Rep causes harm to others while performing duties, the company is liable first but can seek recourse from the Legal Rep if they were at fault.

- Impact on Foreign Investors:

- Due Diligence Priority: Verifying the identity, background, and potential risks associated with a Chinese company’s Legal Representative is paramount. Their actions can deeply bind the company. Assess the Legal Rep’s credibility and track record.

- Contracting Confidence: Provides greater assurance when dealing with the Legal Rep that the company will be bound, even if internal rules were violated (if you acted in good faith).

- Risk Exposure: Highlights the importance of understanding who holds this powerful position and their potential exposure. Consider detailed background checks on key executives.

4. Audit Committees Can Replace Supervisory Boards (Art. 69, 121)

- 2018 Law: Generally required companies (except very small ones) to have a Supervisory Board (监事会 – jiānshì huì) or at least one Supervisor, responsible for monitoring directors and management.

- 2024 Law: Introduces significant flexibility (Art. 69 for LLCs, Art. 121 for JSCs). Companies can now choose to establish an Audit Committee (审计委员会 – shěnjì wěiyuánhuì) within the Board of Directors, composed of directors (including possible employee representatives). If such a committee is established and its constitution meets the law’s requirements (e.g., majority independence for JSCs), the company is exempt from having a Supervisory Board or Supervisor.

- Impact on Foreign Investors:

- Governance Structure Shift: Be aware that the traditional two-tier governance structure (Board + Supervisory Board) might be replaced by a single-tier structure with a powerful Audit Committee in some companies you engage with.

- Due Diligence Focus: When assessing governance, understand whether the company uses a Supervisory Board or an Audit Committee. Scrutinize the independence and expertise of Audit Committee members if applicable. Review governance documents.

- Efficiency vs. Oversight: This offers companies more flexibility, but foreign partners should assess if the Audit Committee model provides robust enough oversight for their risk tolerance.

5. Introduction of “Category Shares” (Class Shares) (Art. 144-147)

- 2018 Law: Primarily recognized ordinary shares. Different rights were possible but less systematically defined under the broad “share class” concept.

- 2024 Law: Formally introduces and regulates “Category Shares” (类别股 – lèibié gǔ) (Art. 144). Companies can issue shares with rights different from ordinary shares, specifically listing:

- Shares with preferential or subordinated rights to profit/asset distribution.

- Shares with multiple or fractional voting rights per share.

- Shares with transfer restrictions (requiring company approval).

- Other types approved by the State Council.

- Restrictions apply, e.g., publicly traded companies generally cannot issue shares with differential voting rights or transfer restrictions (unless pre-existing).

- Impact on Foreign Investors:

- Complex Capital Structures: Potential Chinese partners or acquisition targets might have more complex capital structures involving different share classes with varying rights. Demand full disclosure of share classes and associated rights.

- JV Structuring: Offers new tools for structuring joint ventures or investments, allowing for tailored voting, economic, or exit rights. Requires careful drafting of AoA.

- Due Diligence Essential: Thoroughly understanding the rights attached to each share class held by founders, investors, and other stakeholders is critical to assess control and economic benefits. Map the cap table and rights.

6. Simplified Deregistration Procedures (Art. 240)

- 2018 Law: Deregistration generally required a full liquidation process, which could be lengthy and complex, even for dormant or debt-free companies.

- 2024 Law: Introduces a Simplified Deregistration Process (简易注销程序 – jiǎnyì zhùxiāo chéngxù) for qualifying companies (Art. 240). Key conditions:

- The company incurred no debts during its existence, OR

- It has paid off all debts prior to application.

- All shareholders must sign a commitment attesting to these conditions.

- A 20-day public announcement via the National Enterprise Credit Information Publicity System (NECIPS) is required. If no valid objections arise, deregistration can proceed.

- Crucially: Shareholders bear joint liability for pre-deregistration debts if their commitment was false.

- Impact on Foreign Investors:

- Exiting JVs/SPVs: Streamlines the process for winding up solvent joint ventures or special purpose vehicles with no liabilities, making exits potentially faster and cheaper.

- Counterparty Risk: While simplifying exits, the shareholder commitment and liability clause means you must conduct thorough final checks before agreeing to use this process for a JV. Ensure all liabilities (including contingent, tax, or employment) are resolved.

- Due Diligence Note: If a company you previously engaged with disappears via simplified deregistration, shareholder liability remains a potential recourse for undiscovered debts. Understand the exit mechanism used.

7. Enhanced Rules for State-Owned Enterprises (SOEs / “National Investment Companies”) (Chapter 7, Art. 168-177)

- 2018 Law: SOE rules were less consolidated and detailed within the Company Law framework.

- 2024 Law: Dedicates a full chapter (Chapter 7) to “National Investment Companies” (国家出资公司 – guójiā chūzī gōngsī), covering wholly state-owned enterprises (WOEs) and state-controlled companies (Art. 168). Key provisions include:

- Reinforces the leadership role of the company’s CCP organization in discussing major operational/managerial issues (Art. 170).

- Specific governance rules for WOEs (e.g., no Shareholders’ Meeting; functions performed by the state asset regulator; Board composition requirements including a majority of external directors and employee reps) (Art. 171-176).

- Mandates robust internal supervision, risk control, and compliance systems (Art. 177).

- Impact on Foreign Investors:

- Governance Understanding: When dealing with SOEs, recognize the formalized dual governance structure involving state asset regulators and the Party committee. Decision-making processes might differ significantly from private firms.

- Compliance Focus: SOE partners will likely have stricter internal compliance and reporting requirements, which may impact joint project execution or information sharing. Be mindful of their internal protocols.

- Due Diligence: Assessing the specific governance model and reporting lines within the SOE partner is crucial. Identify key decision-makers and oversight bodies.

8. Liability for Controlling Shareholders Directing Wrongful Acts (Art. 192)

- 2018 Law: While holding directors/managers liable was established, explicit, direct liability for controlling shareholders or actual controllers who instructed wrongdoing was less clearly articulated.

- 2024 Law: Explicitly states (Art. 192) that if a company’s controlling shareholder or actual controller (实际控制人 – shíjì kòngzhì rén) directs a director or senior manager to commit acts that harm the company or shareholder interests, they shall bear joint liability with that director or manager.

- Impact on Foreign Investors:

- Piercing the Corporate Veil: Strengthens the ability to hold ultimate decision-makers accountable, not just the nominal directors/officers. This is significant in complex ownership structures common in China.

- Enhanced Due Diligence: Underscores the critical importance of identifying the ultimate beneficial owners (UBOs) and actual controllers behind a Chinese company, not just the legal representatives or registered shareholders. Understanding their reputation and history is vital. Trace ownership and control chains.

- Stronger Recourse: Provides a clearer legal basis for claims against powerful figures pulling the strings behind harmful corporate actions. Assess the influence of ultimate controllers.

Conclusion: Navigating the New Landscape Requires Proactive Due Diligence

The 2024 Company Law brings substantial changes aimed at modernizing corporate governance, enhancing creditor and minority shareholder protection, and increasing market efficiency. For foreign investors and businesses, these changes translate into both new opportunities (like flexible share classes and easier exits) and significant new risks (stricter capital rules, enhanced liabilities).

The common thread for mitigating risk and seizing opportunity is robust, continuous due diligence. Relying on outdated information or superficial checks is no longer viable. Understanding a Chinese partner’s or target’s capital adequacy, governance structure (Board, Supervisor, or Audit Committee?), share class rights, executive backgrounds (especially the Legal Rep), and the identity and influence of ultimate controllers is fundamental.

Partner with Experts: Navigating these complexities demands specialized knowledge of Chinese corporate law, regulatory filings, and business verification practices. ChinaBizInsight specializes in providing authoritative, up-to-date intelligence on Chinese companies, including comprehensive Enterprise Credit Reports, deep-dive due diligence, and verification of key documents like AoA and shareholder registers. We help you understand the true picture behind the corporate veil. Ensure your investments and partnerships in China are built on solid, compliant foundations. Explore our full suite of Business Verification & Due Diligence Services.

Stay informed, verify thoroughly, and partner wisely.

ChinaBizInsight

Your strategic bridge to transparent business in China.