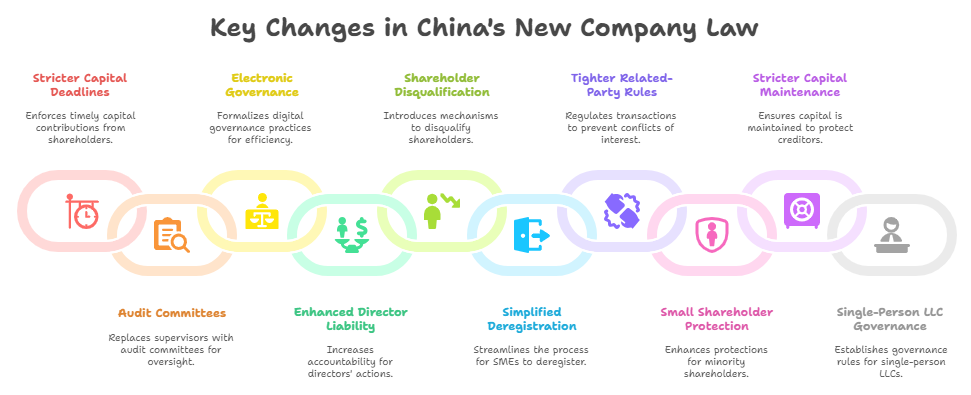

China’s revised Company Law took effect on July 1, 2024, introducing sweeping reforms impacting foreign companies partnering with Chinese entities. Understanding these changes is critical for risk management and compliance. Here are the 10 most significant updates:

1. Stricter Paid-Up Capital Deadlines

Old Rule: No fixed deadline for capital contributions.

New Rule (Art. 47): Shareholders must fully pay subscribed capital within 5 years of company establishment.

Why it matters: Verify a Chinese partner’s actual capital adequacy. Empty promises won’t suffice.

2. Audit Committees Replace Supervisors

New Option (Art. 69, 121): Companies can dissolve their Board of Supervisors and establish Audit Committees (with ≥3 directors) for oversight.

Implication: Streamlines governance but concentrates power. Check if partners use this model and assess internal controls.

3. Electronic Governance Formalized

New Flexibility (Art. 24): Shareholder/board meetings and voting can occur electronically unless prohibited by articles of association.

Practical Impact: Faster decisions but requires digital trail verification.

4. Enhanced Director Liability

Key Change (Art. 51, 188): Directors must actively monitor capital contributions. Failure to enforce payment exposes them to personal liability for company losses.

Due Diligence Tip: Scrutinize target firms’ capital call records and director oversight mechanisms.

5. “Shareholder Disqualification” Mechanism

New Tool (Art. 52): Companies can strip non-paying shareholders of their equity after a 60-day grace period. Forfeited shares must be sold or canceled.

Risk Alert: Confirm partners’ shareholding validity and payment history.

6. Simplified Deregistration for SMEs

New Process (Art. 240): Debt-free companies can deregister via a 20-day online notice + shareholder pledge.

Red Flag: Verify liquidation claims—shareholders face joint liability for false statements.

7. Tighter Related-Party Transaction Rules

Stricter Controls (Art. 182, 185): Directors/executives must disclose conflicts and obtain board/shareholder approval for self-dealing.

Compliance Check: Review target firms’ approval records for transactions with affiliates.

8. Enhanced Small Shareholder Protections

Empowerment (Art. 189): Minority shareholders (≥1% for 180+ days) can sue directors/officers for damages directly.

Opportunity: Leverage this to pressure non-compliant partners.

9. Stricter Capital Maintenance

New Limits (Art. 163): Financial assistance (loans/guarantees) for acquiring company/affiliate shares capped at 10% of issued capital.

Verification Need: Audit financing arrangements of high-debt partners.

10. Single-Person LLC Governance

Clarification (Art. 60): Single-shareholder companies need no shareholder meetings—decisions require written documentation.

Documentation Check: Demand written resolutions for major actions (e.g., loans, asset sales).

Why This Matters for Your China Business

These reforms aim to boost transparency and corporate accountability. Yet for overseas firms, they introduce new verification imperatives:

- Capital Verification: Is your partner’s registered capital truly paid?

- Governance Audits: Do their structures comply with new committee/electronic rules?

- Documentation Gaps: Can they produce shareholder resolutions or capital call records?

At ChinaBizInsight, we help global businesses verify Chinese partners against these new standards. Our reports include:

- Official Paid-Up Capital Confirmation

- Board Structure & Compliance Audits

- Shareholder/Director Liability Checks

“Know your Chinese partners—not just on paper, but in practice.”

Verify compliance today: cnbizinsight’s services

Sources:

[1] Company Law of the People’s Republic of China (Effective July 1, 2024)

[2] China’s State Council Implementation Guidelines (June 2024)

ChinaBizInsight

Your strategic bridge to transparent business in China.